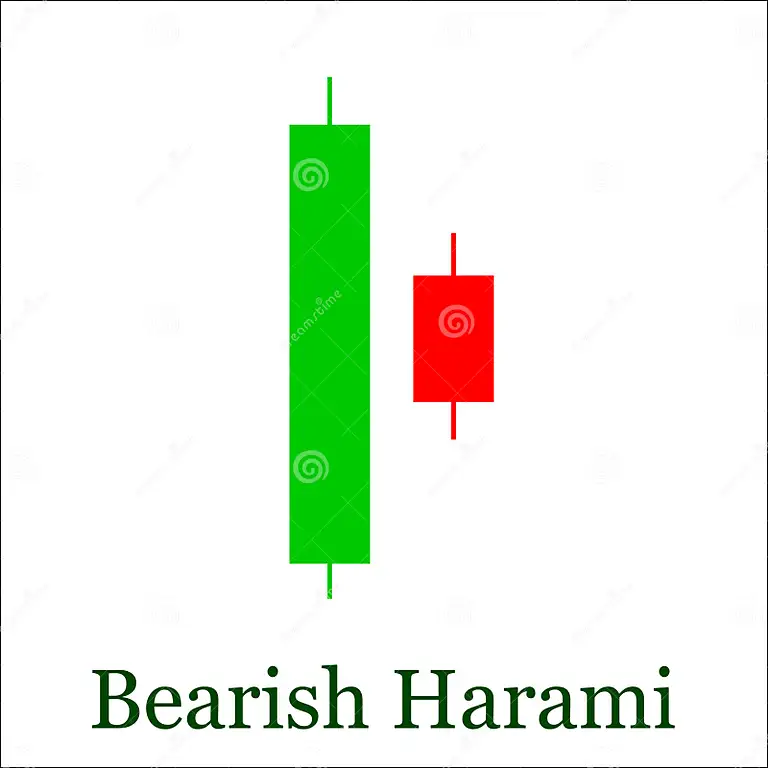

Bearish Harami

The bearish harami is a two-candlestick reversal pattern that signals a potential decline in price. It is formed when a large bullish candle is followed by a smaller bearish candle that is completely contained within the body of the first candle. The pattern is more reliable when it occurs after a strong uptrend.

Here are some tips for trading the bearish harami pattern:

- Look for the pattern to form after a strong uptrend.

- The second candle should be small.

Traders can use technical indicators, such as moving averages and momentum indicators, to confirm the bearish harami pattern.

The bearish harami pattern is a useful tool for traders who are looking to short the market. However, it is important to remember that no single pattern is 100% reliable, and traders should always use caution when trading.

These stocks have formed a Bearish Harami Pattern on 1 Day time frame

| Company Symbol | Sector | Price | Change | Volume | 52wk High | 52wk High | 1Y Beta | P/E | M Cap | Rating |

|---|---|---|---|---|---|---|---|---|---|---|

| ANANDRATHI | Finance | 1,559.90 | -27.00 (-1.70%) | 92,791 | 1,604.30 | 654.00 | -0.11 | 35.82 | 66.2 B | Buy |

| NIRAJ | Industrial Services | 34.50 | -1.60 (-4.43%) | 56,071 | 46.50 | 23.95 | 0.92 | 32.22 | 1.4 B | Sell |