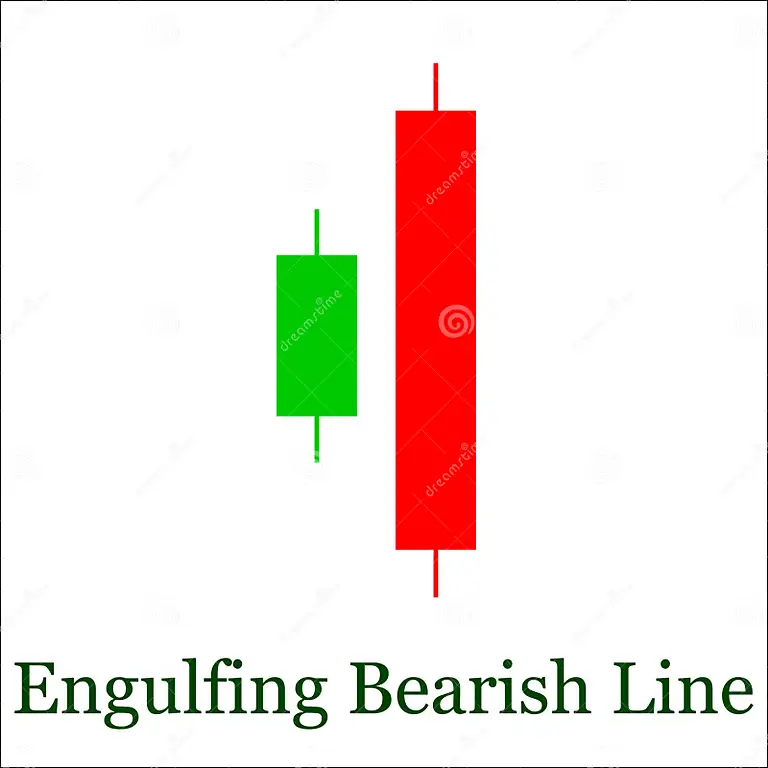

Bearish Engulfing

The bearish engulfing pattern is a two-candle reversal pattern that signals a potential decline in price. It is formed when a small bullish candle is followed by a larger bearish candle that completely engulfs the body of the first candle.

The pattern is more reliable when it occurs after a strong uptrend.

The pattern can be confirmed by other technical indicators, such as moving averages and momentum indicators.

Here are some additional things to keep in mind when trading the bearish engulfing pattern:

- The pattern is less reliable when it occurs after a weak uptrend or a sideways market.

- The pattern can be used to identify potential sell opportunities, but it is important to remember that no single pattern is 100% reliable, and traders should always use caution when trading.

These stocks have formed a Bearish Engulfing Pattern on 1 Day time frame

| Company Symbol | Sector | Price | Change | Volume | 52wk High | 52wk High | 1Y Beta | P/E | M Cap | Rating |

|---|---|---|---|---|---|---|---|---|---|---|

| BALAJITELE | Consumer Services | 63.60 | -2.15 (-3.27%) | 191.6 T | 74.00 | 35.00 | 0.61 | 6.7 B | Neutral | |

| CERA | Consumer Durables | 8,609.75 | -112.65 (-1.29%) | 15,841 | 9,740.00 | 4,963.40 | 0.16 | 49.50 | 113.4 B | Sell |

| DAMODARIND | Process Industries | 50.15 | -0.90 (-1.76%) | 85,308 | 66.85 | 36.55 | 0.60 | 1.2 B | Neutral | |

| DEVIT | Technology Services | 145.50 | -4.05 (-2.71%) | 100,949 | 163.95 | 81.00 | 0.94 | 3.3 B | Buy | |

| DOLLAR | Consumer Non-Durables | 425.10 | -7.95 (-1.84%) | 101,128 | 519.85 | 310.60 | 0.36 | 60.13 | 24.6 B | Sell |

| FORTIS | Health Services | 331.30 | -5.40 (-1.60%) | 875 T | 352.50 | 245.50 | 0.88 | 43.26 | 253.6 B | Neutral |

| GUFICBIO | Health Technology | 280.75 | -5.65 (-1.97%) | 161.7 T | 333.00 | 177.65 | 0.61 | 34.33 | 27.8 B | Sell |

| FLUOROCHEM | Process Industries | 2,996.40 | -39.00 (-1.28%) | 82,339 | 4,173.95 | 2,534.05 | 0.47 | 26.90 | 333.4 B | Sell |

| HILTON | Producer Manufacturing | 164.75 | -1.50 (-0.90%) | 78,435 | 174.00 | 59.45 | 0.80 | 48.02 | 3.5 B | Buy |

| HONDAPOWER | Producer Manufacturing | 2,658.40 | -62.85 (-2.31%) | 5,874 | 2,944.00 | 1,455.00 | 1.85 | 27.78 | 27.6 B | Neutral |

| JSL | Non-Energy Minerals | 456.90 | -6.20 (-1.34%) | 760.2 T | 541.00 | 120.00 | 0.71 | 16.70 | 381.1 B | Neutral |

| JINDWORLD | Process Industries | 362.50 | -9.45 (-2.54%) | 87,779 | 476.70 | 246.15 | -0.48 | 82.88 | 74.5 B | Sell |

| JWL | Producer Manufacturing | 303.55 | -15.90 (-4.98%) | 1.9 M | 411.00 | 67.85 | 0.77 | 69.66 | 127.4 B | Neutral |

| KEC | Industrial Services | 655.90 | -8.60 (-1.29%) | 147,873 | 747.70 | 405.30 | 0.06 | 90.01 | 170.8 B | Sell |

| MACPOWER | Producer Manufacturing | 290.20 | -3.75 (-1.28%) | 19,769 | 419.40 | 207.40 | 21.45 | 2.9 B | Sell | |

| RVHL | Consumer Durables | 34.80 | -1.00 (-2.79%) | 68,390 | 47.95 | 17.10 | 1.03 | 42.71 | 2.2 B | Buy |

| SONAMCLOCK | Consumer Durables | 59.00 | -0.85 (-1.42%) | 5,192 | 67.00 | 33.50 | 1.2 B | Neutral | ||

| SUNTECK | Finance | 433.15 | -2.00 (-0.46%) | 537.3 T | 444.00 | 271.10 | 1.50 | 63.7 B | Buy | |

| TTL | Process Industries | 93.50 | -3.25 (-3.36%) | 20,380 | 110.00 | 64.80 | 0.89 | 2.1 B | Neutral | |

| VIMTALABS | Commercial Services | 539.10 | -5.45 (-1.00%) | 22,209 | 623.15 | 291.85 | 0.82 | 25.19 | 12 B | Neutral |