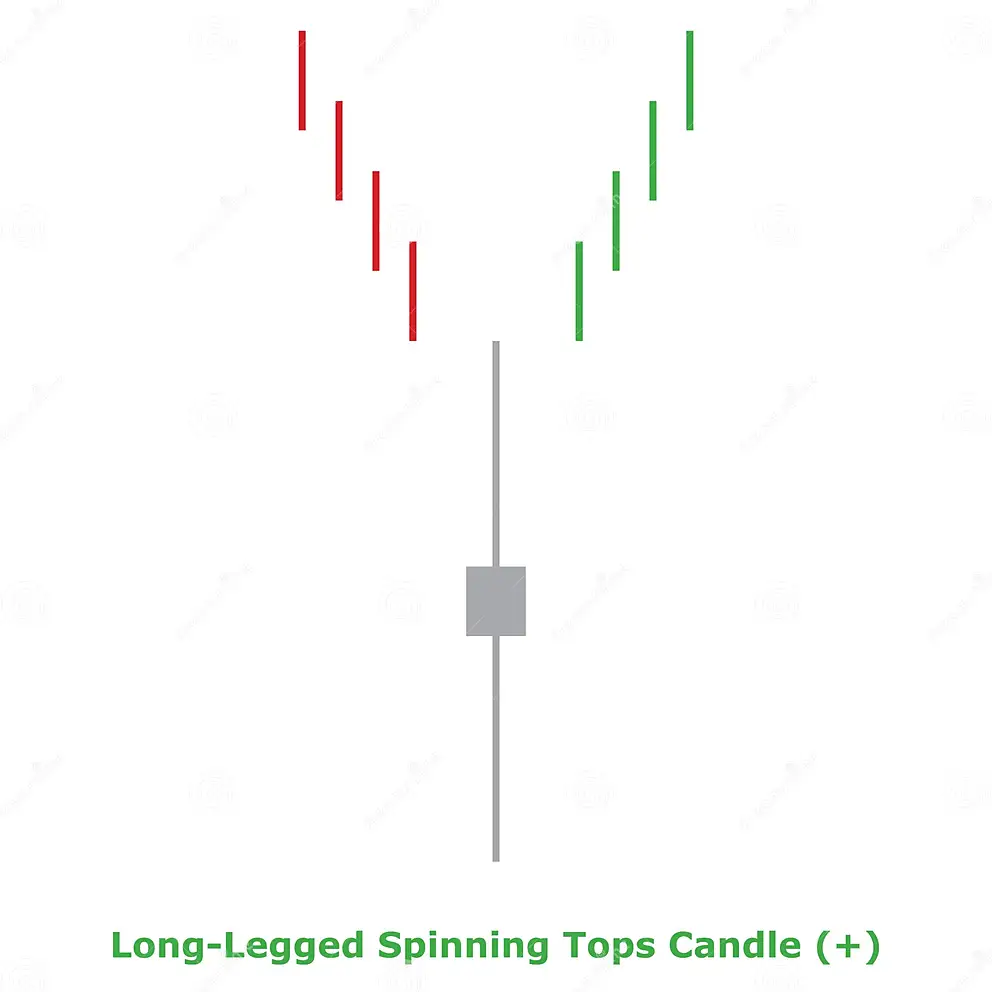

Spinning Top Black

Black spinning tops are candlestick lines that are small, red-bodied, and possess shadows (upper and lower) that end up exceeding the length of candle bodies. They often signal indecision.

These stocks have formed a Spinning Top Black Pattern on 1 Day time frame

| Company Symbol | Sector | Price | Change | Volume | 52wk High | 52wk High | 1Y Beta | P/E | M Cap | Rating |

|---|---|---|---|---|---|---|---|---|---|---|

| AAATECH | Technology Services | 60.50 | 0.80 (1.34%) | 24,330 | 82.65 | 41.85 | 1.48 | 760.1 M | Buy | |

| ADANIPOWER | Utilities | 383.90 | 1.45 (0.38%) | 12 M | 409.70 | 132.40 | 1.19 | 10.07 | 1.5 T | Buy |

| AKSHARCHEM | Process Industries | 303.75 | -0.65 (-0.21%) | 7,519 | 371.90 | 201.05 | 1.09 | 2.4 B | Buy | |

| ADSL | Technology Services | 131.95 | -0.40 (-0.30%) | 203.5 T | 156.90 | 71.55 | 2.35 | 109.17 | 7.3 B | Sell |

| ARROWGREEN | Process Industries | 335.75 | -4.00 (-1.18%) | 10,142 | 404.00 | 91.05 | 1.24 | 19.19 | 5.1 B | Sell |

| ASHOKLEY | Producer Manufacturing | 178.85 | -0.50 (-0.28%) | 8.7 M | 191.50 | 133.10 | 0.91 | 29.51 | 526 B | Sell |

| AVADHSUGAR | Process Industries | 662.60 | -0.85 (-0.13%) | 119,937 | 733.75 | 392.00 | 1.31 | 12.91 | 13.3 B | Buy |

| BHAGCHEM | Process Industries | 1,212.20 | -11.25 (-0.92%) | 2,891 | 1,726.25 | 1,000.00 | 0.45 | 12.7 B | Strong Sell | |

| BBL | Producer Manufacturing | 3,758.85 | -22.70 (-0.60%) | 16,739 | 4,397.95 | 1,781.00 | 2.10 | 23.04 | 21.4 B | Sell |

| BHARATGEAR | Producer Manufacturing | 122.95 | -0.50 (-0.41%) | 35,487 | 172.40 | 98.10 | 1.73 | 22.40 | 1.9 B | Strong Sell |

| BHARATWIRE | Producer Manufacturing | 254.30 | -0.70 (-0.27%) | 223.5 T | 278.70 | 87.30 | 1.87 | 22.51 | 17.4 B | Buy |

| BLBLIMITED | Finance | 22.90 | 0.15 (0.66%) | 57,714 | 38.00 | 17.60 | -1.02 | 16.96 | 1.2 B | Buy |

| CHAMBLFERT | Process Industries | 279.50 | -0.15 (-0.05%) | 1.5 M | 332.45 | 248.40 | 1.17 | 11.28 | 116.4 B | Sell |

| CHEMCON | Process Industries | 283.60 | -1.55 (-0.54%) | 42,264 | 477.95 | 221.00 | 1.29 | 29.21 | 10.4 B | Sell |

| CAMS | Finance | 2,483.40 | -17.40 (-0.70%) | 84,650 | 2,690.00 | 2,010.00 | 0.41 | 41.19 | 122.5 B | Buy |

| DBREALTY | Finance | 160.75 | -1.55 (-0.96%) | 1.6 M | 179.65 | 55.10 | 1.59 | 57.2 B | Buy | |

| DCMSHRIRAM | Producer Manufacturing | 1,048.60 | -12.00 (-1.13%) | 103,177 | 1,119.90 | 730.20 | 0.55 | 22.92 | 165.4 B | Buy |

| DHANBANK | Finance | 28.90 | -0.10 (-0.34%) | 6.2 M | 33.80 | 11.35 | 2.13 | 7.02 | 7.3 B | Buy |

| DCAL | Health Technology | 167.65 | -2.00 (-1.18%) | 2.3 M | 179.20 | 80.00 | 0.37 | 26.6 B | Strong Buy | |

| DIVISLAB | Health Technology | 3,705.05 | -41.75 (-1.11%) | 190 T | 3,934.70 | 2,730.00 | -0.06 | 66.58 | 994 B | Buy |

| DMCC | Process Industries | 322.00 | 0.25 (0.08%) | 7,527 | 412.05 | 228.25 | 0.10 | 209.23 | 8 B | Neutral |

| DYNPRO | Consumer Non-Durables | 351.65 | -3.45 (-0.97%) | 15,691 | 420.00 | 230.00 | 0.24 | 57.35 | 4.1 B | Neutral |

| EKC | Producer Manufacturing | 123.65 | -0.65 (-0.52%) | 332.4 T | 136.80 | 66.00 | 0.44 | 23.44 | 14 B | Buy |

| FMNL | Transportation | 6.05 | -0.05 (-0.82%) | 44,601 | 7.40 | 3.80 | 1.46 | 352.2 M | Buy | |

| GLAXO | Health Technology | 1,560.55 | 4.75 (0.31%) | 143,149 | 1,624.00 | 1,227.00 | 0.13 | 42.39 | 263.2 B | Buy |

| GOCOLORS | Consumer Non-Durables | 1,295.70 | -22.50 (-1.71%) | 73,605 | 1,453.00 | 876.05 | 0.70 | 82.68 | 71.1 B | Sell |

| GOKUL | Process Industries | 33.90 | 0.15 (0.44%) | 76,938 | 44.25 | 25.00 | 1.10 | 17.04 | 3.3 B | Buy |

| GREENLAM | Non-Energy Minerals | 427.65 | -0.75 (-0.18%) | 21,511 | 519.00 | 281.55 | 0.65 | 39.64 | 54.3 B | Sell |

| HGINFRA | Industrial Services | 947.50 | -3.10 (-0.33%) | 42,229 | 1,019.00 | 531.65 | 0.96 | 11.56 | 61.9 B | Sell |

| HINDZINC | Non-Energy Minerals | 313.80 | 0.40 (0.13%) | 195.4 T | 383.00 | 262.65 | -0.07 | 14.13 | 1.3 T | Sell |

| IOB | Finance | 43.85 | 0.90 (2.10%) | 245.1 M | 48.60 | 16.80 | 2.17 | 37.42 | 811.9 B | Buy |

| INDOCO | Health Technology | 340.75 | 0.70 (0.21%) | 64,020 | 423.90 | 306.40 | 1.71 | 24.52 | 31.3 B | Buy |

| JPPOWER | Utilities | 10.40 | -0.05 (-0.48%) | 227.9 M | 10.80 | 5.15 | 1.60 | 71.5 B | Buy | |

| JINDALSAW | Non-Energy Minerals | 346.10 | -6.10 (-1.73%) | 588.3 T | 391.00 | 77.45 | 1.69 | 12.35 | 112.4 B | Neutral |

| KCP | Producer Manufacturing | 115.15 | 0.55 (0.48%) | 162 T | 137.40 | 91.70 | 1.16 | 31.52 | 14.8 B | Sell |

| KESORAMIND | Consumer Durables | 88.10 | 0.20 (0.23%) | 452.9 T | 108.00 | 50.95 | 0.20 | 27.3 B | Neutral | |

| KECL | Producer Manufacturing | 105.70 | -1.10 (-1.03%) | 113,992 | 141.00 | 37.45 | 2.01 | 18.66 | 7.1 B | Sell |

| LGBBROSLTD | Producer Manufacturing | 1,043.90 | -6.95 (-0.66%) | 28,029 | 1,237.60 | 606.85 | 0.35 | 13.16 | 33 B | Buy |

| LIBERTSHOE | Consumer Non-Durables | 246.80 | -0.85 (-0.34%) | 80,564 | 442.00 | 181.20 | -0.38 | 38.99 | 4.2 B | Neutral |

| MANGALAM | Health Technology | 102.10 | 0.65 (0.64%) | 34,128 | 158.50 | 95.25 | 0.40 | 1.6 B | Sell | |

| MMTC | Distribution Services | 57.40 | -0.50 (-0.86%) | 4.1 M | 70.35 | 26.30 | 2.27 | 5.07 | 86.9 B | Buy |

| MUKANDLTD | Non-Energy Minerals | 166.30 | 0.65 (0.39%) | 336.3 T | 198.00 | 98.40 | 0.76 | 13.50 | 24 B | Neutral |

| NSIL | Finance | 2,530.95 | 4.70 (0.19%) | 1,303 | 2,780.00 | 1,519.65 | 1.60 | 12.84 | 12.9 B | Neutral |

| NECCLTD | Transportation | 20.75 | 0.40 (1.97%) | 89,843 | 27.93 | 13.16 | 1.11 | 17.52 | 1.9 B | Neutral |

| ORIENTPPR | Process Industries | 51.35 | 0.15 (0.29%) | 1.5 M | 59.80 | 28.65 | 1.61 | 8.43 | 10.9 B | Buy |

| ORIENTHOT | Consumer Services | 85.05 | -0.85 (-0.99%) | 501.3 T | 98.00 | 63.00 | 1.53 | 29.38 | 15.3 B | Sell |

| PAISALO | Finance | 61.20 | -0.25 (-0.41%) | 631.3 T | 98.00 | 47.70 | 0.50 | 24.71 | 27.6 B | Sell |

| PLASTIBLEN | Process Industries | 232.05 | 0.40 (0.17%) | 36,775 | 258.90 | 138.55 | 0.90 | 24.60 | 6 B | Buy |

| POWERGRID | Utilities | 199.15 | -2.45 (-1.22%) | 21.2 M | 205.95 | 139.76 | 0.47 | 12.18 | 1.9 T | Buy |

| PRINCEPIPE | Producer Manufacturing | 692.70 | -2.60 (-0.37%) | 112,184 | 760.00 | 510.00 | 0.76 | 61.26 | 77 B | Neutral |

| PRSMJOHNSN | Non-Energy Minerals | 128.00 | -0.20 (-0.16%) | 214.3 T | 145.50 | 98.00 | 0.75 | 64.5 B | Sell | |

| ROML | Process Industries | 45.10 | -0.40 (-0.88%) | 4,723 | 59.70 | 34.05 | -0.01 | 37.46 | 1.4 B | Buy |

| RAMCOIND | Non-Energy Minerals | 178.30 | -0.40 (-0.22%) | 68,089 | 198.70 | 117.35 | 0.83 | 14.70 | 15.5 B | Sell |

| RCF | Process Industries | 126.45 | -0.35 (-0.28%) | 3.4 M | 144.85 | 89.50 | 2.46 | 9.50 | 69.9 B | Buy |

| REPCOHOME | Finance | 375.05 | 1.55 (0.41%) | 67,451 | 417.00 | 168.30 | 1.31 | 7.06 | 23.4 B | Neutral |

| RESPONIND | Non-Energy Minerals | 330.80 | 2.20 (0.67%) | 380.6 T | 348.20 | 100.95 | 1.55 | 141.29 | 87.6 B | Buy |

| SJS | Producer Manufacturing | 683.50 | 1.50 (0.22%) | 83,970 | 745.00 | 377.65 | 0.93 | 30.55 | 21.2 B | Buy |

| SALASAR | Producer Manufacturing | 51.35 | -0.15 (-0.29%) | 720.5 T | 58.75 | 27.70 | 1.69 | 37.06 | 16.3 B | Sell |

| SATIA | Process Industries | 131.20 | -1.15 (-0.87%) | 355.8 T | 164.30 | 101.00 | 0.97 | 5.33 | 13.3 B | Neutral |

| STARCEMENT | Producer Manufacturing | 153.45 | 0.70 (0.46%) | 243.2 T | 169.95 | 92.55 | 0.73 | 22.69 | 61.7 B | Sell |

| SUBEXLTD | Technology Services | 33.05 | 0.05 (0.15%) | 3 M | 39.20 | 25.00 | 1.37 | 18.5 B | Neutral | |

| SYNGENE | Commercial Services | 771.45 | -6.20 (-0.80%) | 922.2 T | 860.25 | 535.10 | 1.08 | 64.34 | 312.9 B | Sell |

| TATASTEEL | Non-Energy Minerals | 126.75 | -1.05 (-0.82%) | 34.1 M | 135.00 | 95.00 | 1.28 | 94.97 | 1.6 T | Neutral |

| INDHOTEL | Consumer Services | 406.25 | -0.55 (-0.14%) | 2.5 M | 436.45 | 280.05 | 1.18 | 54.70 | 577.8 B | Neutral |

| TIDEWATER | Energy Minerals | 1,198.15 | 2.25 (0.19%) | 37,003 | 1,274.40 | 805.15 | 1.18 | 18.19 | 20.8 B | Buy |

| TRIDENT | Process Industries | 37.80 | -0.15 (-0.40%) | 7.3 M | 43.75 | 25.05 | 1.37 | 46.74 | 193.4 B | Neutral |

| TV18BRDCST | Consumer Services | 45.75 | -0.15 (-0.33%) | 6.5 M | 51.60 | 27.35 | 1.54 | 61.83 | 78.7 B | Neutral |

| TVSSRICHAK | Consumer Durables | 3,014.30 | 10.30 (0.34%) | 16,208 | 3,699.00 | 2,371.50 | 0.52 | 22.83 | 23 B | Buy |

| VSTTILLERS | Producer Manufacturing | 3,712.95 | 17.60 (0.48%) | 12,049 | 3,865.00 | 2,027.95 | 0.59 | 27.82 | 32 B | Buy |

| VRLLOG | Transportation | 702.80 | -6.90 (-0.97%) | 181.6 T | 772.50 | 483.00 | 0.84 | 35.29 | 62.2 B | Neutral |