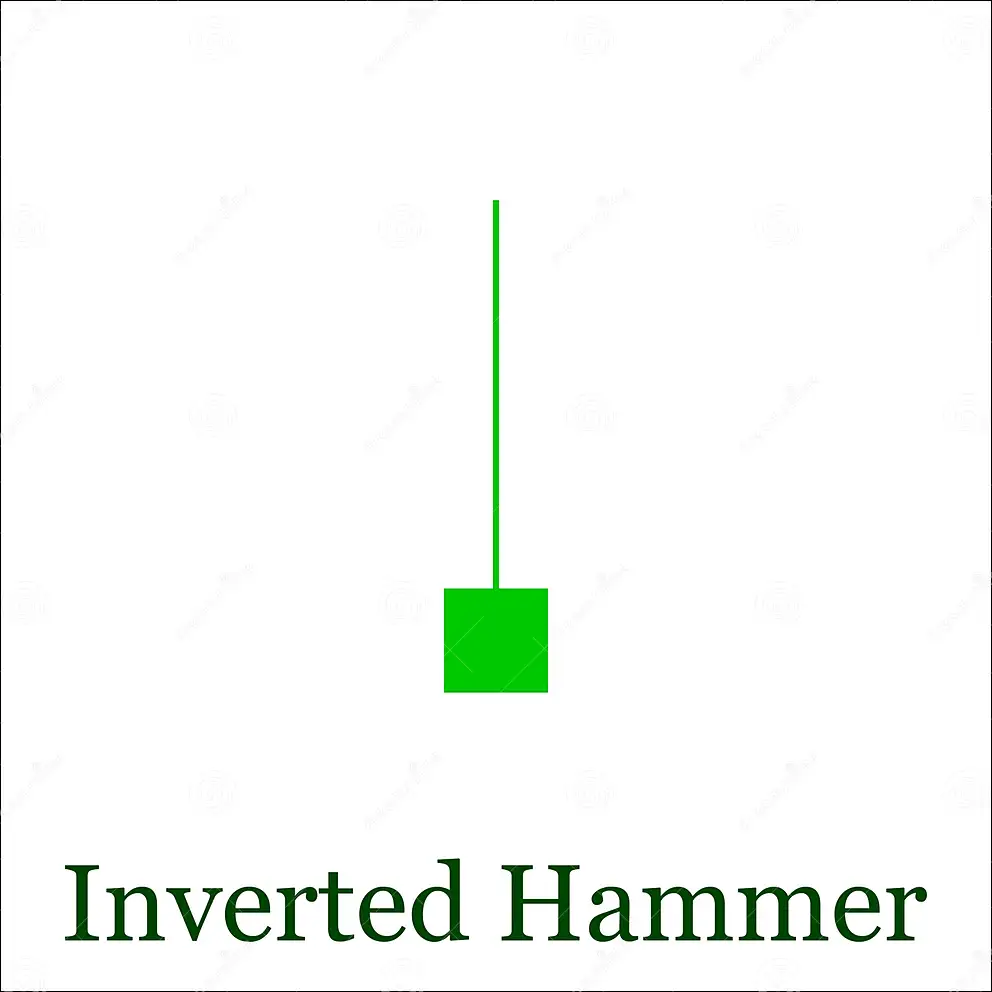

Inverted Hammer

The inverted hammer is a bullish reversal candlestick pattern that occurs at the bottom of a downtrend. It is characterized by a small body and a long upper shadow. The long upper shadow indicates that there was a lot of buying pressure during the day, but the sellers were able to push the price back down to the opening price.

The inverted hammer is a reliable signal of a trend reversal, but it should be used in conjunction with other technical indicators to confirm the pattern.

Here are some tips for trading the inverted hammer pattern:

- Look for the pattern to form after a strong downtrend.

- Enter a long position when the price closes above the open of the inverted hammer.

The inverted hammer is a useful tool for traders who are looking to buy the market, but it is important to remember that no single pattern is 100% reliable, and traders should always use caution when trading.

These stocks have formed a Inverted Hammer Pattern on 1 Day time frame

| Company Symbol | Sector | Price | Change | Volume | 52wk High | 52wk High | 1Y Beta | P/E | M Cap | Rating |

|---|---|---|---|---|---|---|---|---|---|---|

| INFOBEAN | Technology Services | 468.75 | 0.15 (0.03%) | 12,484 | 598.65 | 401.10 | 1.45 | 41.12 | 11.4 B | Strong Sell |

| VISASTEEL | Non-Energy Minerals | 12.60 | -0.35 (-2.70%) | 3.6 M | 19.10 | 10.20 | 1.33 | 0.09 | 1.4 B | Sell |