Ace Integrated Solutions Limited (ACEINTEG)

| Price | 35.45 0.05 (0.14%) | 52 Week High | 82.30 |

|---|---|---|---|

| ISIN | INE543V01017 | 52 Week Low | 33.05 |

| Industry | Data Processing Services | Volume | 370 |

| Sector | Technology Services | P/E Ratio TTM | |

| Market Cap | 361.1 M | 1 Year Beta | 1.41 |

Ace Integrated Solutions Limited (ACEINTEG) is a leading provider of business process outsourcing (BPO) services in India. The company was founded in 2005 and is headquartered in Mumbai, India.

ACEINTEG’s services include customer service, technical support, back-office operations, and IT infrastructure management.

ACEINTEG’s customers include some of the world’s leading companies, such as IBM, Cisco, and HP. The company has a strong track record of growth and is well-positioned for continued growth in the future.

Here are some of the key points about Ace Integrated Solutions Limited:

- Founded in 2005

- Headquartered in Mumbai, India

- Leading provider of BPO services in India

- Customers include some of the world’s leading companies

- Strong track record of growth

- Well-positioned for continued growth in the future

Technical Analysis of Ace Integrated Solutions Limited (ACEINTEG)

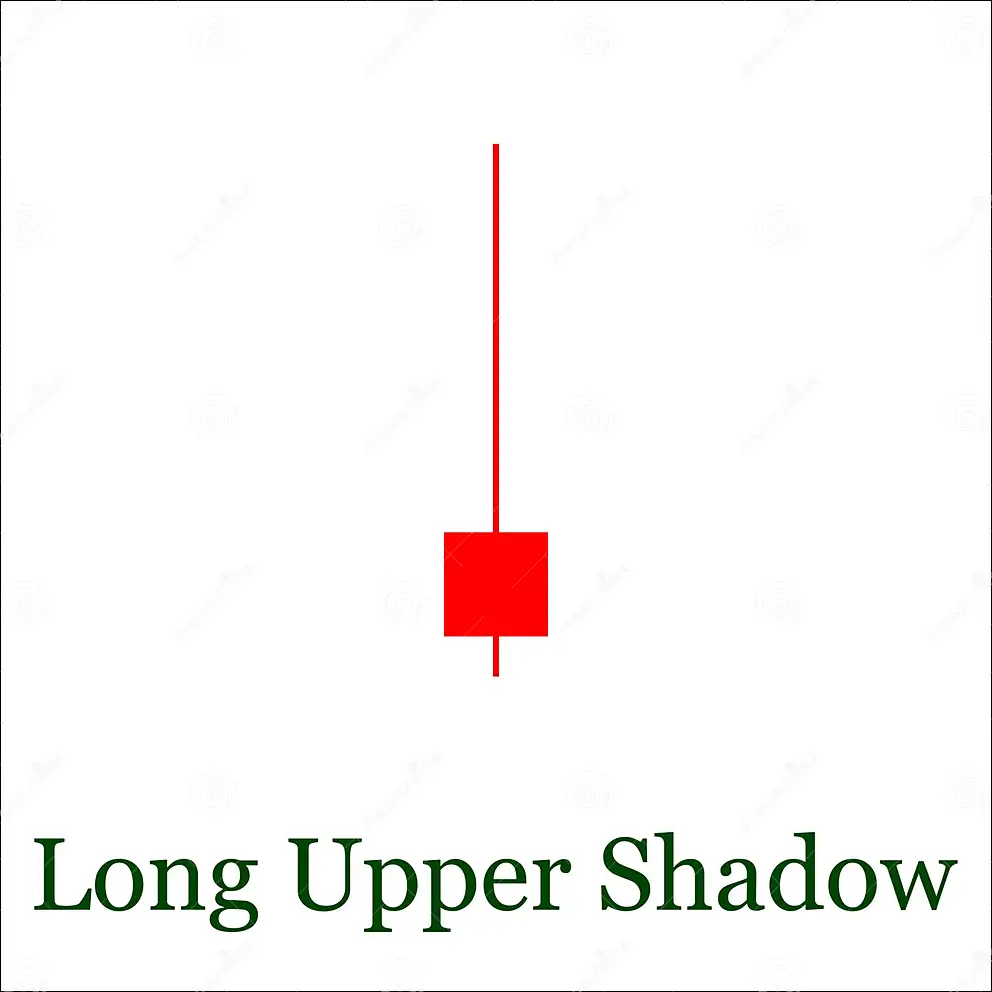

Long Upper Shadow

Long Upper Shadow is formed on Ace Integrated Solutions Limited (ACEINTEG) in 1 Day Timeframe. Long Upper Shadow is a bearish candlestick pattern. To indicate buyer domination of the first part of a session, candlesticks will present with long upper shadows, as well as short lower shadows, consequently raising bidding prices.Moving Averages

| Period | Simple | Exponential |

|---|---|---|

| MA 5 | 36.28 | 35.93 |

| MA 10 | 36.13 | 36.00 |

| MA 20 | 35.67 | 35.97 |

| MA 30 | 35.96 | 36.02 |

| MA 50 | 35.95 | 36.41 |

| MA 100 | 37.72 | 38.52 |

| MA 200 | 44.29 | 44.56 |

Moving Average Rating

Technical Indicators

| Name | Value | Name | Value |

|---|---|---|---|

| Aroon Up (14) | 85.71 | Aroon Down (14) | 50.00 |

| MACD Level (12, 26) | 0.00 | MACD Signal (12, 26) | -0.02 |

| Relative Strength Index (7) | 43.08 | Relative Strength Index (14) | 47.00 |

| Stochastic %D (14 3 3) | 65.77 | Stochastic %K (14 3 3) | 48.91 |

| Stochastic RSI Fast (3, 3, 14, 14) | 33.32 | Stochastic RSI Slow (3, 3, 14, 14) | 60.92 |

| Bollinger Upper Band (20) | 37.50 | Bollinger Lower Band (20) | 33.84 |

| Keltner Channels Upper Band (20) | 39.70 | Keltner Channels Lower Band (20) | 32.23 |

| Donchian Channels Upper Band (20) | 38.60 | Donchian Channels Lower Band (20) | 33.05 |

| Ichimoku Conversion Line (9, 26, 52, 26) | 35.92 | Ichimoku Base Line (9, 26, 52, 26) | 35.82 |

| Ichimoku Leading Span A (9, 26, 52, 26) | 36.81 | Ichimoku Leading Span B (9, 26, 52, 26) | 36.63 |

| Positive Directional Indicator (14) | 9.12 | Negative Directional Indicator (14) | 27.88 |

| Volume Weighted Average Price | 35.93 | Volume Weighted Moving Average 20 | 35.61 |

Oscillator Rating

Oscillators

| Awesome Oscillator | 0.20 |

|---|---|

| Ultimate Oscillator (7,14,28) | 52.97 |

| Money Flow (14) | 51.28 |

| Chaikin Money Flow (20) | -0.02 |

| Commodity Channel Index (20) | 24.39 |

| Bull Bear Power | 0.38 |

High / Low

| 1 Month | 38.60 | 33.05 |

|---|---|---|

| 3 Month | 40.00 | 33.05 |

| 6 Month | 51.50 | 33.05 |

| 52 Week | 82.30 | 33.05 |

| All Time | 82.30 | 33.05 |

Volume

| Volume | 370.00 |

|---|---|

| Average 10 D | 1,850.60 |

| Average 30 D | 3,908.97 |

| Average 60 D | 2,403.73 |

| Average 90 D | 1,987.86 |

Change/Volatility

| Change | 0.05 (0.14%) |

|---|---|

| Change 1W | -1.45 (-3.93%) |

| Change 1M | 0.15 (0.42%) |

| Volatility | 4.38 |

| Volatility W | 4.90 |

Performance

| Yesterday | -31.89 |

|---|---|

| Weekly | 4.26 |

| Monthly | -1.53 |

| 3 Month | -6.71 |

| 6 Month | -16.39 |

| Yearly | -26.91 |

| 5 Year | -26.91 |

| All Time | -26.91 |

Misc.

| Average Day Range (14) | 1.83 |

|---|---|

| Average Directional Index (14) | 26.84 |

| Average True Range (14) | 1.85 |

| Williams Percent Range (14) | -58.88 |

| Rate Of Change (9) | -3.67 |

| Hull Moving Average (9) | 36.05 |

| Momentum (10) | -0.45 |

| Parabolic SAR | 33.46 |

PIVOT POINTS of Ace Integrated Solutions Limited (ACEINTEG)

| Name | S3 | S2 | S1 | Pivot Points | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Classic | 23.22 | 29.57 | 32.43 | 35.92 | 38.78 | 42.27 | 48.62 |

| Fibonacci | 29.57 | 31.99 | 33.49 | 35.92 | 38.34 | 39.84 | 42.27 |

| Camarilla | 33.55 | 34.14 | 34.72 | 35.92 | 35.88 | 36.46 | 37.05 |

| Woodie's | 27.37 | 30.21 | 33.73 | 36.56 | 40.08 | 42.91 | 46.43 |

| DeMark's | - | - | 34.17 | 36.79 | 40.53 | - | - |

Financial Analysis of Ace Integrated Solutions Limited (ACEINTEG)

Income Statement

| Basic EPS (FY) | 0.46 |

|---|---|

| EBITDA (Annual YoY Growth) | -49.30 |

| EBITDA (Quarterly QoQ Growth) | -118.42 |

| EPS Diluted (Annual YoY Growth) | -52.52 |

| EPS Diluted (FY) | 0.46 |

| EPS Diluted (Quarterly QoQ Growth) | -87.51 |

| Free Cash Flow (Annual YoY Growth) | 1,520.00 |

| Free Cash Flow Margin (FY) | 11.72 |

| Gross Profit (Annual YoY Growth) | -48.26 |

| Gross Profit (FY) | 14.9 M |

| Gross Profit (MRQ) | 6.7 M |

| Gross Profit (Quarterly QoQ Growth) | -61.49 |

| Last Year Revenue (FY) | 69.1 M |

| Revenue (Annual YoY Growth) | -20.94 |

| Revenue per Employee (FY) | 6.3 M |

| Revenue (Quarterly QoQ Growth) | -28.96 |

| Net Income (Annual YoY Growth) | -52.53 |

| Net Income (FY) | 4.7 M |

| Net Income (Quarterly QoQ Growth) | -87.50 |

| Total Revenue (FY) | 69.1 M |

Valuation

| Number of Employees | 11.00 |

|---|---|

| Number of Shareholders | 869.00 |

| Shares Float | 2.7 M |

| Price to Book (FY) | 1.96 |

| Price to Sales (FY) | 5.23 |

| Total Shares Outstanding | 10.2 M |

| Selling & Admin expenses Ratio (FY) | 13.46 |

Balance Sheet

| Total Assets (Annual YoY Growth) | -8.46 |

|---|---|

| Total Debt (Annual YoY Growth) | -87.68 |

| Total Liabilities (FY) | 21 M |

| Cash & Equivalents (FY) | 17.9 M |

| Cash and short term investments (FY) | 27.9 M |

Operating Metrics

Dividends

Margins

| Net Margin (FY) | 6.80 |

|---|---|

| Gross Margin (FY) | 21.56 |

| Operating Margin (FY) | 8.10 |

Related Companies (Peers) to Ace Integrated Solutions Limited (ACEINTEG)

| Price | 264.85 2.25 (0.86%) | 52 Week High | 302.00 |

|---|---|---|---|

| ISIN | INE153T01027 | 52 Week Low | 131.75 |

| Industry | Data Processing Services | Volume | 1.5 M |

| Sector | Technology Services | P/E Ratio TTM | 45.46 |

| Market Cap | 108.1 B | 1 Year Beta | 2.16 |

| Price | 911.60 -11.35 (-1.23%) | 52 Week High | 1,043.65 |

|---|---|---|---|

| ISIN | INE419U01012 | 52 Week Low | 763.25 |

| Industry | Data Processing Services | Volume | 233.7 T |

| Sector | Technology Services | P/E Ratio TTM | 56.73 |

| Market Cap | 140.4 B | 1 Year Beta | 0.60 |

| Price | 50.10 1.00 (2.04%) | 52 Week High | 64.60 |

|---|---|---|---|

| ISIN | INE596H01014 | 52 Week Low | 29.15 |

| Industry | Data Processing Services | Volume | 3,839 |

| Sector | Technology Services | P/E Ratio TTM | 18.29 |

| Market Cap | 629.7 M | 1 Year Beta | 2.51 |

| Price | 99.25 0.90 (0.92%) | 52 Week High | 127.00 |

|---|---|---|---|

| ISIN | INE864K01010 | 52 Week Low | 65.65 |

| Industry | Data Processing Services | Volume | 8,191 |

| Sector | Technology Services | P/E Ratio TTM | 42.23 |

| Market Cap | 2 B | 1 Year Beta | 0.53 |

Stock Sectors

- 52Commercial Services

- 13Communications

- 72Consumer Durables

- 111Consumer Non-Durables

- 81Consumer Services

- 33Distribution Services

- 49Electronic Technology

- 18Energy Minerals

- 245Finance

- 20Health Services

- 95Health Technology

- 85Industrial Services

- 2Miscellaneous

- 134Non-Energy Minerals

- 357Process Industries

- 270Producer Manufacturing

- 31Retail Trade

- 103Technology Services

- 41Transportation

- 38Utilities

Stock Industries

- 3Advertising/Marketing Services

- 7Aerospace & Defense

- 62Agricultural Commodities/Milling

- 14Air Freight/Couriers

- 3Airlines

- 6Alternative Power Generation

- 4Aluminum

- 39Apparel/Footwear

- 9Apparel/Footwear Retail

- 64Auto Parts: OEM

- 11Automotive Aftermarket

- 9Beverages: Alcoholic

- 1Beverages: Non-Alcoholic

- 1Biotechnology

- 12Broadcasting

- 17Building Products

- 4Cable/Satellite TV

- 1Catalog/Specialty Distribution

- 40Chemicals: Agricultural

- 18Chemicals: Major Diversified

- 75Chemicals: Specialty

- 3Coal

- 4Commercial Printing/Forms

- 1Computer Communications

- 4Computer Peripherals

- 37Construction Materials

- 3Consumer Sundries

- 25Containers/Packaging

- 2Contract Drilling

- 5Data Processing Services

- 1Department Stores

- 1Drugstore Chains

- 25Electric Utilities

- 46Electrical Products

- 3Electronic Components

- 9Electronic Equipment/Instruments

- 11Electronic Production Equipment

- 4Electronics Distributors

- 1Electronics/Appliance Stores

- 9Electronics/Appliances

- 75Engineering & Construction

- 1Environmental Services

- 55Finance/Rental/Leasing

- 28Financial Conglomerates

- 3Financial Publishing/Services

- 3Food Distributors

- 3Food Retail

- 7Food: Major Diversified

- 7Food: Meat/Fish/Dairy

- 28Food: Specialty/Candy

- 9Forest Products

- 7Gas Distributors

- 10Home Furnishings

- 1Home Improvement Chains

- 7Homebuilding

- 13Hospital/Nursing Management

- 18Hotels/Resorts/Cruise lines

- 14Household/Personal Care

- 9Industrial Conglomerates

- 51Industrial Machinery

- 35Industrial Specialties

- 54Information Technology Services

- 3Integrated Oil

- 7Internet Retail

- 11Internet Software/Services

- 43Investment Banks/Brokers

- 16Investment Managers

- 1Investment Trusts/Mutual Funds

- 6Life/Health Insurance

- 18Major Banks

- 6Major Telecommunications

- 6Marine Shipping

- 1Medical Distributors

- 2Medical Specialties

- 7Medical/Nursing Services

- 32Metal Fabrication

- 1Miscellaneous

- 39Miscellaneous Commercial Services

- 24Miscellaneous Manufacturing

- 14Motor Vehicles

- 21Movies/Entertainment

- 4Multi-Line Insurance

- 3Office Equipment/Supplies

- 1Oil & Gas Pipelines

- 1Oil & Gas Production

- 11Oil Refining/Marketing

- 6Oilfield Services/Equipment

- 7Other Consumer Services

- 20Other Consumer Specialties

- 19Other Metals/Minerals

- 10Other Transportation

- 33Packaged Software

- 3Personnel Services

- 2Pharmaceuticals: Generic

- 84Pharmaceuticals: Major

- 6Pharmaceuticals: Other

- 1Precious Metals

- 4Publishing: Books/Magazines

- 7Publishing: Newspapers

- 18Pulp & Paper

- 1Railroads

- 51Real Estate Development

- 22Regional Banks

- 8Restaurants

- 3Semiconductors

- 2Specialty Insurance

- 7Specialty Stores

- 5Specialty Telecommunications

- 64Steel

- 11Telecommunications Equipment

- 84Textiles

- 3Tobacco

- 1Tools & Hardware

- 7Trucking

- 24Trucks/Construction/Farm Machinery

- 25Wholesale Distributors

- 2Wireless Telecommunications

Leave a Reply