AKI India Limited (AKI)

| Price | 11.60 -0.20 (-1.69%) | 52 Week High | 24.52 |

|---|---|---|---|

| ISIN | INE642Z01026 | 52 Week Low | 11.60 |

| Industry | Textiles | Volume | 27,926 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 811.2 M | 1 Year Beta | 0.62 |

AKI India Limited (AKI) is an Indian leather products manufacturer headquartered in Kanpur, Uttar Pradesh, India. It was incorporated in 1994.

- The company’s initial focus was on the manufacturing of leather footwear. AKI has since expanded its operations to include a wide range of leather goods, including bags, belts, and wallets.

- AKI is one of the leading leather products manufacturers in India. The company’s products are sold across the country and exported to over 30 countries.

- AKI is a publicly traded company, listed on the Bombay Stock Exchange and the National Stock Exchange of India. The company has a market capitalization of over ₹200 crore (US$25 million).

- AKI is well-positioned for continued growth in the future. The company is targeting to expand its product portfolio and increase its market share.

Here are some of the key points about AKI India Limited:

- Founded in 1994

- Headquartered in Kanpur, Uttar Pradesh, India

- One of the leading leather products manufacturers in India

- Products sold across the country and exported to over 30 countries

- Publicly traded company

- Market capitalization of over ₹200 crore (US$25 million)

- Well-positioned for continued growth in the future

AKI India Limited (AKI) Chart

Technical Analysis of AKI India Limited (AKI)

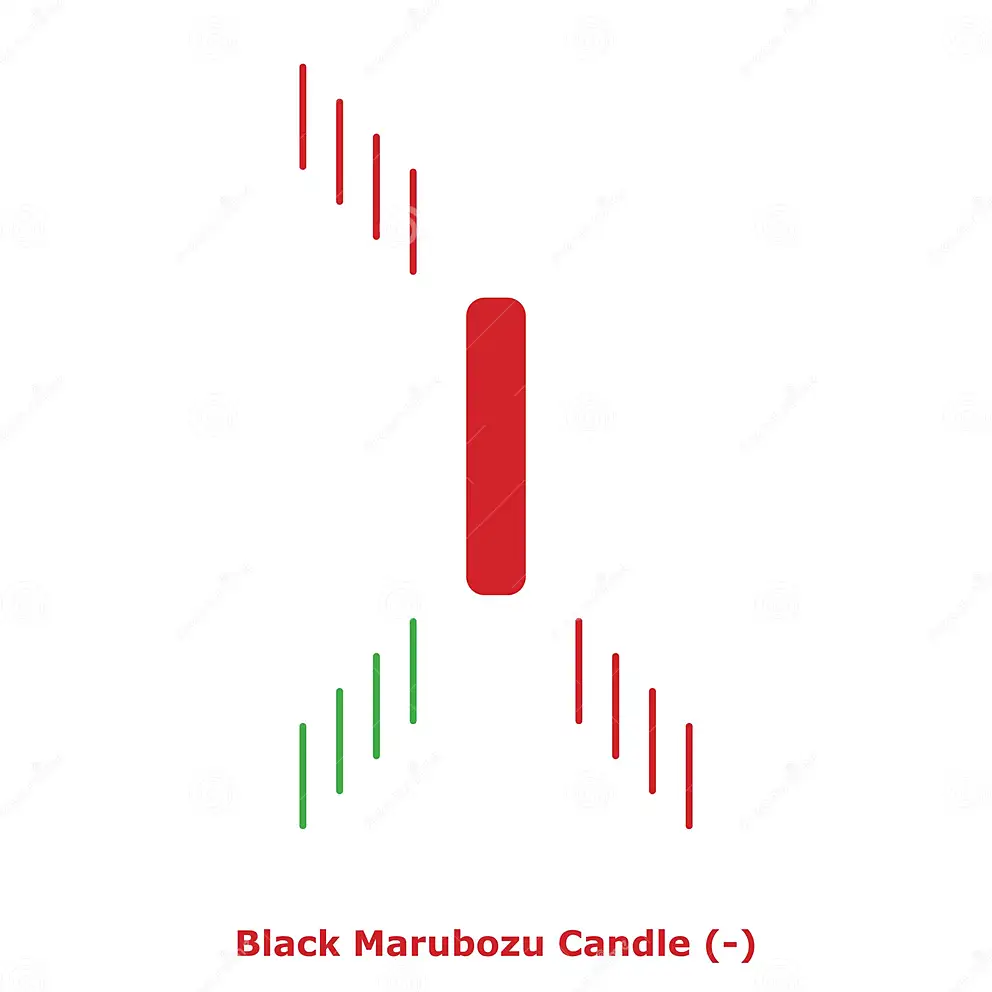

Marubozu Black

Marubozu Black is formed on AKI India Limited (AKI) in 1 Day Timeframe. This is a red candlestick that has no shadow extending from the body either at the open or the close. In Japanese, the name means “close-cropped” or “close-cut.” The candlestick can also be referred to as Bald or Shaven Head.Moving Averages

| Period | Simple | Exponential |

|---|---|---|

| MA 5 | 12.04 | 12.05 |

| MA 10 | 12.65 | 12.63 |

| MA 20 | 13.95 | 13.65 |

| MA 30 | 14.18 | 14.60 |

| MA 50 | 17.00 | 16.12 |

| MA 100 | 19.41 | 18.72 |

| MA 200 |

Moving Average Rating

Technical Indicators

| Name | Value | Name | Value |

|---|---|---|---|

| Aroon Up (14) | 0.00 | Aroon Down (14) | 100.00 |

| MACD Level (12, 26) | -1.39 | MACD Signal (12, 26) | -1.34 |

| Relative Strength Index (7) | 7.77 | Relative Strength Index (14) | 18.68 |

| Stochastic %D (14 3 3) | 0.00 | Stochastic %K (14 3 3) | 0.00 |

| Stochastic RSI Fast (3, 3, 14, 14) | 0.00 | Stochastic RSI Slow (3, 3, 14, 14) | 0.00 |

| Bollinger Upper Band (20) | 16.99 | Bollinger Lower Band (20) | 10.92 |

| Keltner Channels Upper Band (20) | 14.34 | Keltner Channels Lower Band (20) | 12.96 |

| Donchian Channels Upper Band (20) | 16.65 | Donchian Channels Lower Band (20) | 11.60 |

| Ichimoku Conversion Line (9, 26, 52, 26) | 12.55 | Ichimoku Base Line (9, 26, 52, 26) | 14.13 |

| Ichimoku Leading Span A (9, 26, 52, 26) | 17.75 | Ichimoku Leading Span B (9, 26, 52, 26) | 18.65 |

| Positive Directional Indicator (14) | 12.56 | Negative Directional Indicator (14) | 62.17 |

| Volume Weighted Average Price | 11.67 | Volume Weighted Moving Average 20 | 14.24 |

Oscillator Rating

Oscillators

| Awesome Oscillator | -2.56 |

|---|---|

| Ultimate Oscillator (7,14,28) | 5.48 |

| Money Flow (14) | 0.00 |

| Chaikin Money Flow (20) | -0.14 |

| Commodity Channel Index (20) | -120.63 |

| Bull Bear Power | -2.48 |

High / Low

| 1 Month | 16.65 | 11.60 |

|---|---|---|

| 3 Month | 23.75 | 11.60 |

| 6 Month | 24.52 | 11.60 |

| 52 Week | 24.52 | 11.60 |

| All Time | 24.52 | 11.60 |

Volume

| Volume | 27,926.00 |

|---|---|

| Average 10 D | 32,254.90 |

| Average 30 D | 60,295.90 |

| Average 60 D | 89,921.72 |

| Average 90 D | 196.9 T |

Change/Volatility

| Change | -0.20 (-1.69%) |

|---|---|

| Change 1W | -0.90 (-7.20%) |

| Change 1M | -3.80 (-24.68%) |

| Volatility | 1.72 |

| Volatility W | 1.68 |

Performance

| Yesterday | -25.74 |

|---|---|

| Weekly | -8.66 |

| Monthly | -23.43 |

| 3 Month | -49.34 |

| 6 Month | -25.74 |

| Yearly | -25.74 |

| 5 Year | -25.74 |

| All Time | -25.74 |

Misc.

| Average Day Range (14) | 0.12 |

|---|---|

| Average Directional Index (14) | 49.75 |

| Average True Range (14) | 0.44 |

| Williams Percent Range (14) | -100.00 |

| Rate Of Change (9) | -15.64 |

| Hull Moving Average (9) | 11.57 |

| Momentum (10) | -2.40 |

| Parabolic SAR | 13.41 |

PIVOT POINTS of AKI India Limited (AKI)

| Name | S3 | S2 | S1 | Pivot Points | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Classic | 6.77 | 11.08 | 16.92 | 21.23 | 27.07 | 37.22 | |

| Fibonacci | 6.77 | 10.64 | 13.04 | 16.92 | 20.79 | 23.19 | 27.07 |

| Camarilla | 12.61 | 13.54 | 14.47 | 16.92 | 16.33 | 17.26 | 18.19 |

| Woodie's | 6.24 | 10.03 | 16.39 | 20.18 | 26.54 | 30.33 | |

| DeMark's | - | - | 8.93 | 15.84 | 19.08 | - | - |

Financial Analysis of AKI India Limited (AKI)

Income Statement

| Basic EPS (FY) | 0.15 |

|---|---|

| EBITDA (Annual YoY Growth) | 71.06 |

| EBITDA (Quarterly QoQ Growth) | -20.81 |

| EPS Diluted (Annual YoY Growth) | 27.62 |

| EPS Diluted (FY) | 0.15 |

| EPS Diluted (Quarterly QoQ Growth) | 154.00 |

| Free Cash Flow Margin (FY) | 2.16 |

| Gross Profit (Annual YoY Growth) | 208.37 |

| Gross Profit (FY) | 93.9 M |

| Gross Profit (MRQ) | 16.5 M |

| Gross Profit (Quarterly QoQ Growth) | -34.64 |

| Last Year Revenue (FY) | 702.6 M |

| Revenue (Annual YoY Growth) | 76.80 |

| Revenue (Quarterly QoQ Growth) | -0.87 |

| Net Income (Annual YoY Growth) | 50.91 |

| Net Income (FY) | 11.6 M |

| Net Income (Quarterly QoQ Growth) | 46.97 |

| Total Revenue (FY) | 702.6 M |

Valuation

| Total Shares Outstanding | 66.9 M |

|---|---|

| Selling & Admin expenses Ratio (FY) | 11.92 |

Balance Sheet

| Total Assets (Annual YoY Growth) | 42.27 |

|---|---|

| Total Debt (Annual YoY Growth) | 18.43 |

| Total Liabilities (FY) | 482.7 M |

| Cash & Equivalents (FY) | 14.7 M |

| Cash and short term investments (FY) | 14.7 M |

Operating Metrics

Dividends

Margins

| Net Margin (FY) | 1.64 |

|---|---|

| Gross Margin (FY) | 13.37 |

| Operating Margin (FY) | 1.44 |

Related Companies (Peers) to AKI India Limited (AKI)

| Price | 24.55 -0.30 (-1.21%) | 52 Week High | 30.00 |

|---|---|---|---|

| ISIN | INE273D01019 | 52 Week Low | 16.25 |

| Industry | Textiles | Volume | 29,968 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 581.8 M | 1 Year Beta | 1.05 |

| Price | 7.15 -0.10 (-1.38%) | 52 Week High | 11.89 |

|---|---|---|---|

| ISIN | INE256Z01017 | 52 Week Low | 2.97 |

| Industry | Textiles | Volume | 29,977 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 1.8 B | 1 Year Beta | 0.69 |

| Price | 18.70 -0.25 (-1.32%) | 52 Week High | 22.40 |

|---|---|---|---|

| ISIN | INE270A01029 | 52 Week Low | 10.10 |

| Industry | Textiles | Volume | 9.9 M |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 94 B | 1 Year Beta | 0.38 |

| Price | 1,578.35 -27.35 (-1.70%) | 52 Week High | 1,749.80 |

|---|---|---|---|

| ISIN | INE540G01014 | 52 Week Low | 1,314.20 |

| Industry | Textiles | Volume | 12,763 |

| Sector | Process Industries | P/E Ratio TTM | 9.64 |

| Market Cap | 9.2 B | 1 Year Beta | 0.51 |

| Price | 167.05 2.70 (1.64%) | 52 Week High | 180.60 |

|---|---|---|---|

| ISIN | INE034A01011 | 52 Week Low | 77.70 |

| Industry | Textiles | Volume | 675.2 T |

| Sector | Process Industries | P/E Ratio TTM | 11.73 |

| Market Cap | 43 B | 1 Year Beta | 1.13 |

| Price | 13.10 0.00 (0.00%) | 52 Week High | 18.30 |

|---|---|---|---|

| ISIN | INE440A01010 | 52 Week Low | 12.15 |

| Industry | Textiles | Volume | 68,553 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 2.5 B | 1 Year Beta | 0.62 |

| Price | 67.20 0.55 (0.83%) | 52 Week High | 94.00 |

|---|---|---|---|

| ISIN | INE193B01039 | 52 Week Low | 58.00 |

| Industry | Textiles | Volume | 20,550 |

| Sector | Process Industries | P/E Ratio TTM | 47.71 |

| Market Cap | 3.4 B | 1 Year Beta | 1.19 |

| Price | 47.80 -0.10 (-0.21%) | 52 Week High | 59.90 |

|---|---|---|---|

| ISIN | INE186H01022 | 52 Week Low | 34.15 |

| Industry | Textiles | Volume | 38,861 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 3.1 B | 1 Year Beta | 1.60 |

| Price | 151.85 -0.70 (-0.46%) | 52 Week High | 188.65 |

|---|---|---|---|

| ISIN | INE629D01020 | 52 Week Low | 95.00 |

| Industry | Textiles | Volume | 36,897 |

| Sector | Process Industries | P/E Ratio TTM | 5.01 |

| Market Cap | 5.2 B | 1 Year Beta | 1.29 |

| Price | 146.20 7.10 (5.10%) | 52 Week High | 168.60 |

|---|---|---|---|

| ISIN | INE032A01023 | 52 Week Low | 53.25 |

| Industry | Textiles | Volume | 4.7 M |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 28.7 B | 1 Year Beta | 1.82 |

| Price | 165.30 -3.25 (-1.93%) | 52 Week High | 236.70 |

|---|---|---|---|

| ISIN | INE594B01012 | 52 Week Low | 111.20 |

| Industry | Textiles | Volume | 7,143 |

| Sector | Process Industries | P/E Ratio TTM | 10.35 |

| Market Cap | 1.7 B | 1 Year Beta | 1.46 |

| Price | 1,086.50 69.60 (6.84%) | 52 Week High | 1,140.00 |

|---|---|---|---|

| ISIN | INE055A01016 | 52 Week Low | 588.00 |

| Industry | Textiles | Volume | 1.3 M |

| Sector | Process Industries | P/E Ratio TTM | 55.24 |

| Market Cap | 113.7 B | 1 Year Beta | 1.41 |

| Price | 1,163.70 -7.75 (-0.66%) | 52 Week High | 1,351.50 |

|---|---|---|---|

| ISIN | INE974B01016 | 52 Week Low | 960.30 |

| Industry | Textiles | Volume | 2,394 |

| Sector | Process Industries | P/E Ratio TTM | 11.41 |

| Market Cap | 7.1 B | 1 Year Beta | 0.50 |

| Price | 50.15 -0.90 (-1.76%) | 52 Week High | 66.85 |

|---|---|---|---|

| ISIN | INE497D01022 | 52 Week Low | 36.55 |

| Industry | Textiles | Volume | 85,308 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 1.2 B | 1 Year Beta | 0.60 |

| Price | 162.80 -2.30 (-1.39%) | 52 Week High | 189.70 |

|---|---|---|---|

| ISIN | INE08KP01019 | 52 Week Low | 129.00 |

| Industry | Textiles | Volume | 12,197 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 3.1 B | 1 Year Beta | 1.87 |

| Price | 96.55 -5.05 (-4.97%) | 52 Week High | 147.35 |

|---|---|---|---|

| ISIN | INE731U01028 | 52 Week Low | 78.40 |

| Industry | Textiles | Volume | 5,962 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 1.9 B | 1 Year Beta | 0.56 |

| Price | 106.75 4.95 (4.86%) | 52 Week High | 121.90 |

|---|---|---|---|

| ISIN | INE668D01028 | 52 Week Low | 53.55 |

| Industry | Textiles | Volume | 584.8 T |

| Sector | Process Industries | P/E Ratio TTM | 15.24 |

| Market Cap | 5.3 B | 1 Year Beta | 0.75 |

| Price | 2.30 -0.10 (-4.17%) | 52 Week High | 4.20 |

|---|---|---|---|

| ISIN | INE962C01027 | 52 Week Low | 1.75 |

| Industry | Textiles | Volume | 817 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 186.3 M | 1 Year Beta | 1.27 |

| Price | 12.30 -0.25 (-1.99%) | 52 Week High | 15.60 |

|---|---|---|---|

| ISIN | INE022C01012 | 52 Week Low | 8.90 |

| Industry | Textiles | Volume | 1 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 99.5 M | 1 Year Beta | -0.80 |

| Price | 359.25 -13.70 (-3.67%) | 52 Week High | 436.95 |

|---|---|---|---|

| ISIN | INE963C01033 | 52 Week Low | 247.80 |

| Industry | Textiles | Volume | 49,094 |

| Sector | Process Industries | P/E Ratio TTM | 15.58 |

| Market Cap | 9.1 B | 1 Year Beta | 0.60 |

| Price | 46.90 2.65 (5.99%) | 52 Week High | 55.25 |

|---|---|---|---|

| ISIN | INE816B01035 | 52 Week Low | 30.15 |

| Industry | Textiles | Volume | 674.8 T |

| Sector | Process Industries | P/E Ratio TTM | 32.42 |

| Market Cap | 19.7 B | 1 Year Beta | 1.02 |

| Price | 1.05 -0.05 (-4.55%) | 52 Week High | 2.20 |

|---|---|---|---|

| ISIN | INE623B01027 | 52 Week Low | 0.45 |

| Industry | Textiles | Volume | 348.9 T |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 644.4 M | 1 Year Beta | 1.12 |

| Price | 5.45 -0.25 (-4.39%) | 52 Week High | 8.90 |

|---|---|---|---|

| ISIN | IN9623B01058 | 52 Week Low | 3.90 |

| Industry | Textiles | Volume | 11,975 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 644.4 M | 1 Year Beta | 0.80 |

| Price | 962.90 -7.70 (-0.79%) | 52 Week High | 1,147.95 |

|---|---|---|---|

| ISIN | INE845D01014 | 52 Week Low | 597.05 |

| Industry | Textiles | Volume | 74,251 |

| Sector | Process Industries | P/E Ratio TTM | 35.18 |

| Market Cap | 21.2 B | 1 Year Beta | 0.63 |

| Price | 629.05 17.65 (2.89%) | 52 Week High | 696.10 |

|---|---|---|---|

| ISIN | INE539A01019 | 52 Week Low | 464.15 |

| Industry | Textiles | Volume | 211.5 T |

| Sector | Process Industries | P/E Ratio TTM | 5.03 |

| Market Cap | 58.5 B | 1 Year Beta | 0.69 |

| Price | 77.05 2.00 (2.66%) | 52 Week High | 86.00 |

|---|---|---|---|

| ISIN | INE0PA801013 | 52 Week Low | 58.70 |

| Industry | Textiles | Volume | 178.5 T |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 7.2 B | 1 Year Beta | -0.35 |

| Price | 28.00 -0.55 (-1.93%) | 52 Week High | 39.05 |

|---|---|---|---|

| ISIN | INE424C01010 | 52 Week Low | 16.05 |

| Industry | Textiles | Volume | 20,941 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 2.4 B | 1 Year Beta | 2.06 |

| Price | 138.15 0.25 (0.18%) | 52 Week High | 162.05 |

|---|---|---|---|

| ISIN | INE049A01027 | 52 Week Low | 67.60 |

| Industry | Textiles | Volume | 434.4 T |

| Sector | Process Industries | P/E Ratio TTM | 68.66 |

| Market Cap | 13.5 B | 1 Year Beta | 1.32 |

| Price | 241.35 1.15 (0.48%) | 52 Week High | 255.00 |

|---|---|---|---|

| ISIN | INE483B01026 | 52 Week Low | 101.25 |

| Industry | Textiles | Volume | 314.2 T |

| Sector | Process Industries | P/E Ratio TTM | 17.48 |

| Market Cap | 47.5 B | 1 Year Beta | 1.70 |

| Price | 50.80 -1.40 (-2.68%) | 52 Week High | 68.90 |

|---|---|---|---|

| ISIN | INE156A01020 | 52 Week Low | 36.30 |

| Industry | Textiles | Volume | 134,222 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 13.6 B | 1 Year Beta | 0.64 |

| Price | 362.50 -9.45 (-2.54%) | 52 Week High | 476.70 |

|---|---|---|---|

| ISIN | INE247D01039 | 52 Week Low | 246.15 |

| Industry | Textiles | Volume | 87,779 |

| Sector | Process Industries | P/E Ratio TTM | 82.88 |

| Market Cap | 74.5 B | 1 Year Beta | -0.48 |

| Price | 670.40 4.55 (0.68%) | 52 Week High | 746.00 |

|---|---|---|---|

| ISIN | INE645L01011 | 52 Week Low | 360.00 |

| Industry | Textiles | Volume | 11,548 |

| Sector | Process Industries | P/E Ratio TTM | 16.82 |

| Market Cap | 10 B | 1 Year Beta | 0.80 |

| Price | 195.05 -1.05 (-0.54%) | 52 Week High | 237.70 |

|---|---|---|---|

| ISIN | INE602G01020 | 52 Week Low | 136.00 |

| Industry | Textiles | Volume | 65,152 |

| Sector | Process Industries | P/E Ratio TTM | 45.05 |

| Market Cap | 13 B | 1 Year Beta | 1.47 |

| Price | 65.05 -0.95 (-1.44%) | 52 Week High | 76.45 |

|---|---|---|---|

| ISIN | INE548Z01017 | 52 Week Low | 40.50 |

| Industry | Textiles | Volume | 12,366 |

| Sector | Process Industries | P/E Ratio TTM | 23.41 |

| Market Cap | 1.2 B | 1 Year Beta |

| Price | 162.95 -6.85 (-4.03%) | 52 Week High | 240.95 |

|---|---|---|---|

| ISIN | INE112F01022 | 52 Week Low | 88.15 |

| Industry | Textiles | Volume | 55,926 |

| Sector | Process Industries | P/E Ratio TTM | 12.40 |

| Market Cap | 1.8 B | 1 Year Beta | -0.07 |

| Price | 22.00 -0.30 (-1.35%) | 52 Week High | 27.80 |

|---|---|---|---|

| ISIN | INE801V01019 | 52 Week Low | 17.15 |

| Industry | Textiles | Volume | 31,239 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 382.4 M | 1 Year Beta | 1.01 |

| Price | 640.45 -0.25 (-0.04%) | 52 Week High | 925.05 |

|---|---|---|---|

| ISIN | INE970D01010 | 52 Week Low | 529.80 |

| Industry | Textiles | Volume | 1,207 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 3.1 B | 1 Year Beta | 0.76 |

| Price | 137.60 -5.25 (-3.68%) | 52 Week High | 168.35 |

|---|---|---|---|

| ISIN | INE784W01015 | 52 Week Low | 110.05 |

| Industry | Textiles | Volume | 9,207 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 2.6 B | 1 Year Beta | -1.15 |

| Price | 76.00 -2.40 (-3.06%) | 52 Week High | 84.45 |

|---|---|---|---|

| ISIN | INE882A01013 | 52 Week Low | 45.60 |

| Industry | Textiles | Volume | 62,644 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 3.3 B | 1 Year Beta | 1.13 |

| Price | 495.20 -3.10 (-0.62%) | 52 Week High | 583.90 |

|---|---|---|---|

| ISIN | INE040D01038 | 52 Week Low | 393.20 |

| Industry | Textiles | Volume | 26,451 |

| Sector | Process Industries | P/E Ratio TTM | 20.22 |

| Market Cap | 21.9 B | 1 Year Beta | 0.40 |

| Price | 16.80 -0.40 (-2.33%) | 52 Week High | 17.95 |

|---|---|---|---|

| ISIN | INE997Y01019 | 52 Week Low | 6.90 |

| Industry | Textiles | Volume | 25,799 |

| Sector | Process Industries | P/E Ratio TTM | 37.33 |

| Market Cap | 509 M | 1 Year Beta | 1.43 |

| Price | 14.95 -0.25 (-1.64%) | 52 Week High | 19.60 |

|---|---|---|---|

| ISIN | INE954E01012 | 52 Week Low | 10.95 |

| Industry | Textiles | Volume | 67,783 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 218 M | 1 Year Beta | 0.79 |

| Price | 21.10 -0.45 (-2.09%) | 52 Week High | 28.35 |

|---|---|---|---|

| ISIN | INE161G01027 | 52 Week Low | 16.00 |

| Industry | Textiles | Volume | 28,432 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 772.1 M | 1 Year Beta | 2.12 |

| Price | 53.05 4.80 (9.95%) | 52 Week High | 68.00 |

|---|---|---|---|

| ISIN | INE123B01028 | 52 Week Low | 28.30 |

| Industry | Textiles | Volume | 221.2 T |

| Sector | Process Industries | P/E Ratio TTM | 29.22 |

| Market Cap | 600.1 M | 1 Year Beta | 1.67 |

| Price | 135.60 -0.95 (-0.70%) | 52 Week High | 156.40 |

|---|---|---|---|

| ISIN | INE289A01011 | 52 Week Low | 84.10 |

| Industry | Textiles | Volume | 51,740 |

| Sector | Process Industries | P/E Ratio TTM | 11.74 |

| Market Cap | 5.9 B | 1 Year Beta | 1.54 |

| Price | 253.10 -1.85 (-0.73%) | 52 Week High | 349.90 |

|---|---|---|---|

| ISIN | INE308A01027 | 52 Week Low | 198.85 |

| Industry | Textiles | Volume | 16,212 |

| Sector | Process Industries | P/E Ratio TTM | 37.40 |

| Market Cap | 6.3 B | 1 Year Beta | 1.17 |

| Price | 260.85 -3.45 (-1.31%) | 52 Week High | 323.00 |

|---|---|---|---|

| ISIN | INE290A01027 | 52 Week Low | 214.00 |

| Industry | Textiles | Volume | 41,539 |

| Sector | Process Industries | P/E Ratio TTM | 44.72 |

| Market Cap | 9.5 B | 1 Year Beta | 0.76 |

| Price | 23.85 0.20 (0.85%) | 52 Week High | 31.00 |

|---|---|---|---|

| ISIN | INE875G01030 | 52 Week Low | 15.05 |

| Industry | Textiles | Volume | 153.5 T |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 3.4 B | 1 Year Beta | 1.43 |

| Price | 285.00 2.30 (0.81%) | 52 Week High | 335.00 |

|---|---|---|---|

| ISIN | INE229H01012 | 52 Week Low | 182.00 |

| Industry | Textiles | Volume | 82,659 |

| Sector | Process Industries | P/E Ratio TTM | 12.51 |

| Market Cap | 15.9 B | 1 Year Beta | 0.79 |

| Price | 163.60 1.30 (0.80%) | 52 Week High | 199.60 |

|---|---|---|---|

| ISIN | INE231G01010 | 52 Week Low | 114.05 |

| Industry | Textiles | Volume | 5,492 |

| Sector | Process Industries | P/E Ratio TTM | 12.75 |

| Market Cap | 4.5 B | 1 Year Beta | 0.63 |

| Price | 1.65 0.05 (3.13%) | 52 Week High | 1.65 |

|---|---|---|---|

| ISIN | INE162C01024 | 52 Week Low | 0.10 |

| Industry | Textiles | Volume | 721.4 T |

| Sector | Process Industries | P/E Ratio TTM | 179.35 |

| Market Cap | 481.3 M | 1 Year Beta | -25.25 |

| Price | 34.75 0.05 (0.14%) | 52 Week High | 40.45 |

|---|---|---|---|

| ISIN | INE818B01023 | 52 Week Low | 22.35 |

| Industry | Textiles | Volume | 83,738 |

| Sector | Process Industries | P/E Ratio TTM | 11.83 |

| Market Cap | 3.1 B | 1 Year Beta | 1.18 |

| Price | 228.55 1.70 (0.75%) | 52 Week High | 258.20 |

|---|---|---|---|

| ISIN | INE283A01014 | 52 Week Low | 128.10 |

| Industry | Textiles | Volume | 10,261 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 2.7 B | 1 Year Beta | 0.47 |

| Price | 266.65 1.95 (0.74%) | 52 Week High | 308.00 |

|---|---|---|---|

| ISIN | INE084Q01012 | 52 Week Low | 232.50 |

| Industry | Textiles | Volume | 6,568 |

| Sector | Process Industries | P/E Ratio TTM | 335.79 |

| Market Cap | 4.3 B | 1 Year Beta | 0.90 |

| Price | 40.15 -0.45 (-1.11%) | 52 Week High | 89.75 |

|---|---|---|---|

| ISIN | INE533D01032 | 52 Week Low | 16.20 |

| Industry | Textiles | Volume | 3,421 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 22.5 B | 1 Year Beta | 0.38 |

| Price | 1,838.05 -25.80 (-1.38%) | 52 Week High | 2,240.00 |

|---|---|---|---|

| ISIN | INE301A01014 | 52 Week Low | 984.20 |

| Industry | Textiles | Volume | 270 T |

| Sector | Process Industries | P/E Ratio TTM | 8.09 |

| Market Cap | 124.2 B | 1 Year Beta | 1.29 |

| Price | 199.70 -0.70 (-0.35%) | 52 Week High | 217.90 |

|---|---|---|---|

| ISIN | INE750D01016 | 52 Week Low | 129.00 |

| Industry | Textiles | Volume | 5,327 |

| Sector | Process Industries | P/E Ratio TTM | 13.17 |

| Market Cap | 1.5 B | 1 Year Beta | 1.08 |

| Price | 188.70 -1.15 (-0.61%) | 52 Week High | 231.88 |

|---|---|---|---|

| ISIN | INE611A01016 | 52 Week Low | 144.00 |

| Industry | Textiles | Volume | 196.9 T |

| Sector | Process Industries | P/E Ratio TTM | 52.49 |

| Market Cap | 9 B | 1 Year Beta | 0.88 |

| Price | 258.05 -4.50 (-1.71%) | 52 Week High | 323.25 |

|---|---|---|---|

| ISIN | INE498E01010 | 52 Week Low | 212.00 |

| Industry | Textiles | Volume | 1,433 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 1.4 B | 1 Year Beta | 1.66 |

| Price | 338.30 -1.70 (-0.50%) | 52 Week High | 393.00 |

|---|---|---|---|

| ISIN | INE495C01010 | 52 Week Low | 194.65 |

| Industry | Textiles | Volume | 30,104 |

| Sector | Process Industries | P/E Ratio TTM | 17.27 |

| Market Cap | 17 B | 1 Year Beta | 0.95 |

| Price | 50.80 0.80 (1.60%) | 52 Week High | 59.90 |

|---|---|---|---|

| ISIN | INE453D01025 | 52 Week Low | 32.40 |

| Industry | Textiles | Volume | 107,817 |

| Sector | Process Industries | P/E Ratio TTM | 23.39 |

| Market Cap | 4.2 B | 1 Year Beta | 1.49 |

| Price | 119.30 0.00 (0.00%) | 52 Week High | 772.50 |

|---|---|---|---|

| ISIN | INE105I01020 | 52 Week Low | 101.00 |

| Industry | Textiles | Volume | 9,468 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 4 B | 1 Year Beta | -1.00 |

| Price | 71.65 -1.15 (-1.58%) | 52 Week High | 139.85 |

|---|---|---|---|

| ISIN | INE644Y01017 | 52 Week Low | 60.65 |

| Industry | Textiles | Volume | 11,060 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 642.4 M | 1 Year Beta | 1.01 |

| Price | 139.35 -0.60 (-0.43%) | 52 Week High | 170.65 |

|---|---|---|---|

| ISIN | INE705C01020 | 52 Week Low | 107.10 |

| Industry | Textiles | Volume | 5,245 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 1.8 B | 1 Year Beta | 0.20 |

| Price | 578.55 3.55 (0.62%) | 52 Week High | 635.00 |

|---|---|---|---|

| ISIN | INE076B01028 | 52 Week Low | 399.30 |

| Industry | Textiles | Volume | 88,599 |

| Sector | Process Industries | P/E Ratio TTM | 11.78 |

| Market Cap | 26.8 B | 1 Year Beta | 1.44 |

| Price | 19.80 -0.40 (-1.98%) | 52 Week High | 50.25 |

|---|---|---|---|

| ISIN | INE314C01013 | 52 Week Low | 6.75 |

| Industry | Textiles | Volume | 3,888 |

| Sector | Process Industries | P/E Ratio TTM | 0.41 |

| Market Cap | 661.3 M | 1 Year Beta | -2.95 |

| Price | 1.80 0.05 (2.86%) | 52 Week High | 3.00 |

|---|---|---|---|

| ISIN | INE376C01020 | 52 Week Low | 0.80 |

| Industry | Textiles | Volume | 7,120 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 152.6 M | 1 Year Beta | 0.99 |

| Price | 802.35 -4.70 (-0.58%) | 52 Week High | 948.15 |

|---|---|---|---|

| ISIN | INE885H01011 | 52 Week Low | 638.00 |

| Industry | Textiles | Volume | 14,846 |

| Sector | Process Industries | P/E Ratio TTM | 15.75 |

| Market Cap | 10.2 B | 1 Year Beta | 1.01 |

| Price | 19.20 -2.10 (-9.86%) | 52 Week High | 25.30 |

|---|---|---|---|

| ISIN | INE353H01010 | 52 Week Low | 11.05 |

| Industry | Textiles | Volume | 1 M |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 585 M | 1 Year Beta | 0.99 |

| Price | 3.00 0.10 (3.45%) | 52 Week High | 7.40 |

|---|---|---|---|

| ISIN | INE235C01010 | 52 Week Low | 2.00 |

| Industry | Textiles | Volume | 988.2 T |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 310.9 M | 1 Year Beta | 1.77 |

| Price | 8.15 -0.05 (-0.61%) | 52 Week High | 11.35 |

|---|---|---|---|

| ISIN | INE662A01027 | 52 Week Low | 5.40 |

| Industry | Textiles | Volume | 58,698 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 450.4 M | 1 Year Beta | 1.38 |

| Price | 66.90 -0.50 (-0.74%) | 52 Week High | 73.75 |

|---|---|---|---|

| ISIN | INE713B01026 | 52 Week Low | 43.45 |

| Industry | Textiles | Volume | 18,659 |

| Sector | Process Industries | P/E Ratio TTM | 29.02 |

| Market Cap | 1.3 B | 1 Year Beta | 0.69 |

| Price | 52.25 -0.65 (-1.23%) | 52 Week High | 73.60 |

|---|---|---|---|

| ISIN | INE645H01027 | 52 Week Low | 38.00 |

| Industry | Textiles | Volume | 237.7 T |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 8.8 B | 1 Year Beta | 0.92 |

| Price | 93.50 -3.25 (-3.36%) | 52 Week High | 110.00 |

|---|---|---|---|

| ISIN | INE592B01016 | 52 Week Low | 64.80 |

| Industry | Textiles | Volume | 20,380 |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 2.1 B | 1 Year Beta | 0.89 |

| Price | 238.90 -0.55 (-0.23%) | 52 Week High | 326.90 |

|---|---|---|---|

| ISIN | INE301D01026 | 52 Week Low | 137.10 |

| Industry | Textiles | Volume | 22,996 |

| Sector | Process Industries | P/E Ratio TTM | 24.32 |

| Market Cap | 8 B | 1 Year Beta | 1.75 |

| Price | 37.80 -0.15 (-0.40%) | 52 Week High | 43.75 |

|---|---|---|---|

| ISIN | INE064C01022 | 52 Week Low | 25.05 |

| Industry | Textiles | Volume | 7.3 M |

| Sector | Process Industries | P/E Ratio TTM | 46.74 |

| Market Cap | 193.4 B | 1 Year Beta | 1.37 |

| Price | 101.50 -0.45 (-0.44%) | 52 Week High | 150.00 |

|---|---|---|---|

| ISIN | INE368U01011 | 52 Week Low | 35.95 |

| Industry | Textiles | Volume | 2,426 |

| Sector | Process Industries | P/E Ratio TTM | 31.11 |

| Market Cap | 2.1 B | 1 Year Beta | -1.27 |

| Price | 393.25 5.90 (1.52%) | 52 Week High | 418.95 |

|---|---|---|---|

| ISIN | INE825A01020 | 52 Week Low | 270.00 |

| Industry | Textiles | Volume | 103,493 |

| Sector | Process Industries | P/E Ratio TTM | 18.57 |

| Market Cap | 112 B | 1 Year Beta | 1.65 |

| Price | 1.75 0.00 (0.00%) | 52 Week High | 5.70 |

|---|---|---|---|

| ISIN | INE098201036 | 52 Week Low | 1.70 |

| Industry | Textiles | Volume | 466.6 T |

| Sector | Process Industries | P/E Ratio TTM | 27.05 |

| Market Cap | 232.6 M | 1 Year Beta | 0.83 |

| Price | 3.05 0.05 (1.67%) | 52 Week High | 16.80 |

|---|---|---|---|

| ISIN | INE01KI01027 | 52 Week Low | 2.45 |

| Industry | Textiles | Volume | 65,239 |

| Sector | Process Industries | P/E Ratio TTM | 42.13 |

| Market Cap | 718.8 M | 1 Year Beta | -0.93 |

| Price | 1.00 -0.05 (-4.76%) | 52 Week High | 1.50 |

|---|---|---|---|

| ISIN | INE370E01029 | 52 Week Low | 0.75 |

| Industry | Textiles | Volume | 408.4 T |

| Sector | Process Industries | P/E Ratio TTM | |

| Market Cap | 301.5 M | 1 Year Beta | 1.31 |

| Price | 18.55 0.00 (0.00%) | 52 Week High | 25.95 |

|---|---|---|---|

| ISIN | INE755Q01025 | 52 Week Low | 14.20 |

| Industry | Textiles | Volume | 135,375 |

| Sector | Process Industries | P/E Ratio TTM | 10.13 |

| Market Cap | 3.7 B | 1 Year Beta | 1.82 |

| Price | 100.30 1.10 (1.11%) | 52 Week High | 132.65 |

|---|---|---|---|

| ISIN | INE080A01014 | 52 Week Low | 70.30 |

| Industry | Textiles | Volume | 10,728 |

| Sector | Process Industries | P/E Ratio TTM | 24.26 |

| Market Cap | 1.6 B | 1 Year Beta | 1.60 |

News Related to AKI India Limited (AKI)

Sep 22, 2023, 9:59 pm

Technical Analysis Report for Nifty and Three Buy Calls The Nifty index has been on a strong uptrend in the past three weeks, but it has recently retraced some of those gains. It is now expected to oscillate within the 19,605 to 19,878 range over the next few sessions. Three stocks that look good for buying over the next 2-3 weeks are Havells India, KSB, and Gujarat Ambuja Exports. All three stocks have strong bullish momentum and are trading above their key moving averages.

Sep 22, 2023, 9:23 pm

SEBI penalizes 11 entities for non-genuine trades in illiquid stock options segment The Securities and Exchange Board of India (SEBI) has penalized 11 entities for non-genuine trades, fined 2 entities for flouting disclosure rules, and suspended the registration of 1 research firm for violating regulatory norms. SEBI's actions are a reminder to market participants that they must comply with all regulatory requirements. Investors should be aware of these risks and take necessary precautions to protect themselves.

Sep 22, 2023, 8:47 pm

GBP/USD Expected to Slide Towards 1.22, GBPINR Expected to Move Towards 101.40 GBP/USD and GBP/INR Expected to Weaken The British pound is expected to weaken against the US dollar and the Indian rupee in the near term. The GBP/USD pair is expected to slide towards 1.22 as long as it trades under 1.2350, while the GBP/INR pair is expected to move towards 101.40 as long as it trades below 102.50. This is based on technical analysis, which is a method of forecasting future price movements based on historical price patterns and trends.

Sep 22, 2023, 6:12 pm

Electronics Mart India Promoter Sells 2.5% Stake, Stock Falls 5% Electronics Mart India stock fell 5% on September 22 after promoter Pavan Kumar Bajaj sold a 2.5% stake in the company. Motilal Oswal Mutual Fund picked up a 1.57% stake in the company at the same time. The company's revenue and net profit rose in the April-June quarter, and operating profit margins expanded.

Sep 20, 2023, 11:31 pm

Signature Global IPO: Key Details, Analyst Views, and Risks Signature Global (India), the largest real estate development company in the Delhi NCR region in affordable and lower mid-segment housing, is launching its IPO on September 20, 2023. The company plans to raise Rs 730 crore through the IPO, which will be listed on both the NSE and BSE. Analysts are divided on the Signature Global IPO. Some analysts believe that the company is well-positioned in the affordable and lower mid-segment housing market, while others are concerned about the company's net loss, negative net worth, and dependence on the real estate market in the Delhi- NCR region.

Sep 20, 2023, 10:56 pm

EMS Limited: A Good Investment Opportunity for Professional Investors EMS Limited, a water and wastewater management company, is expected to list strongly on September 21. The company's IPO was subscribed 75.28 times, driven by strong demand from qualified institutional buyers, high networth individuals, and retail investors. EMS has a proven track record of successful project execution and a strong order book. It also has a healthy financial position. Analysts are positive on the company and advise investors who are allotted shares to hold them from a medium to long term perspective. Professional investors should carefully consider the company's strong fundamentals and long-term growth outlook before making an investment decision.

Sep 20, 2023, 10:47 am

PSU stocks rally may pressure government for disinvestment PSU stocks have rallied in recent times, which could pressure the government to disinvest in these companies in the run up to the 2023 state elections and 2024 general elections. The government may need to boost social spending ahead of the elections, which could lead to a sharp increase in expenses. A PSU rally could raise the chances of disinvestment in the near-term, as the government would need to raise funds to meet these expenses. Jefferies is cautious on the overall markets for the near-term, given higher global yields, rising crude prices, and rich valuations. They have trimmed weight on mid-cap industrial and property plays and shifted focus toward

Sep 20, 2023, 10:07 am

Amber Enterprises and Noise JV to boost smart wearables manufacturing in India Amber Enterprises India Limited and Noise have entered into a joint venture (JV) agreement to boost the manufacturing and innovation of smart wearables in India. The JV will combine the two companies' strengths and expertise to create a strong vertically integrated ecosystem for smart wearables manufacturing and innovation in India. The JV is expected to have a number of positive benefits for the Indian smart wearables market, including increased domestic manufacturing, more affordable and accessible smart wearables, and growth of the local smart wearables ecosystem. The JV is also aligned with the Indian government's Make in India initiative. In addition to boosting manufacturing, the JV is also expected to focus on innovation.

Sep 20, 2023, 10:02 am

Nifty50 consolidation likely in range of 20,200-19,900 Indian equity markets are expected to consolidate in the coming days, with the Nifty50 likely to move in the 20,200-19,900 range. The market may remain directionless until the outcome of the two-day Fed policy meeting scheduled on September 20. Investors should be cautious and avoid making any aggressive bets. It is important to focus on quality stocks with strong fundamentals and maintain a diversified portfolio across different asset classes and sectors. Investors may want to watch stocks like Mahindra & Mahindra, Yes Bank, and Bank of Baroda.

Sep 20, 2023, 9:56 am

Business updates for September 19, 2023 Tata Motors, Biocon, RR Kabel, BHEL, Wipro, Prakash Industries, Blue Star, LTIMindtree, BL Kashyap and Sons, NBCC (India), HDFC Bank, JK Lakshmi Cement, Zydus Lifesciences, Sasken Technologies, DCM Shriram, Jindal Steel & Power, Union Bank of India, Central Bank of India, Indian Railway Finance Corporation, and ADF Foods announce various business updates, including new appointments, partnerships, product launches, and investments.

Stock Sectors

- 52Commercial Services

- 13Communications

- 72Consumer Durables

- 111Consumer Non-Durables

- 81Consumer Services

- 33Distribution Services

- 49Electronic Technology

- 18Energy Minerals

- 245Finance

- 20Health Services

- 95Health Technology

- 85Industrial Services

- 2Miscellaneous

- 134Non-Energy Minerals

- 357Process Industries

- 270Producer Manufacturing

- 31Retail Trade

- 103Technology Services

- 41Transportation

- 38Utilities

Stock Industries

- 3Advertising/Marketing Services

- 7Aerospace & Defense

- 62Agricultural Commodities/Milling

- 14Air Freight/Couriers

- 3Airlines

- 6Alternative Power Generation

- 4Aluminum

- 39Apparel/Footwear

- 9Apparel/Footwear Retail

- 64Auto Parts: OEM

- 11Automotive Aftermarket

- 9Beverages: Alcoholic

- 1Beverages: Non-Alcoholic

- 1Biotechnology

- 12Broadcasting

- 17Building Products

- 4Cable/Satellite TV

- 1Catalog/Specialty Distribution

- 40Chemicals: Agricultural

- 18Chemicals: Major Diversified

- 75Chemicals: Specialty

- 3Coal

- 4Commercial Printing/Forms

- 1Computer Communications

- 4Computer Peripherals

- 37Construction Materials

- 3Consumer Sundries

- 25Containers/Packaging

- 2Contract Drilling

- 5Data Processing Services

- 1Department Stores

- 1Drugstore Chains

- 25Electric Utilities

- 46Electrical Products

- 3Electronic Components

- 9Electronic Equipment/Instruments

- 11Electronic Production Equipment

- 4Electronics Distributors

- 1Electronics/Appliance Stores

- 9Electronics/Appliances

- 75Engineering & Construction

- 1Environmental Services

- 55Finance/Rental/Leasing

- 28Financial Conglomerates

- 3Financial Publishing/Services

- 3Food Distributors

- 3Food Retail

- 7Food: Major Diversified

- 7Food: Meat/Fish/Dairy

- 28Food: Specialty/Candy

- 9Forest Products

- 7Gas Distributors

- 10Home Furnishings

- 1Home Improvement Chains

- 7Homebuilding

- 13Hospital/Nursing Management

- 18Hotels/Resorts/Cruise lines

- 14Household/Personal Care

- 9Industrial Conglomerates

- 51Industrial Machinery

- 35Industrial Specialties

- 54Information Technology Services

- 3Integrated Oil

- 7Internet Retail

- 11Internet Software/Services

- 43Investment Banks/Brokers

- 16Investment Managers

- 1Investment Trusts/Mutual Funds

- 6Life/Health Insurance

- 18Major Banks

- 6Major Telecommunications

- 6Marine Shipping

- 1Medical Distributors

- 2Medical Specialties

- 7Medical/Nursing Services

- 32Metal Fabrication

- 1Miscellaneous

- 39Miscellaneous Commercial Services

- 24Miscellaneous Manufacturing

- 14Motor Vehicles

- 21Movies/Entertainment

- 4Multi-Line Insurance

- 3Office Equipment/Supplies

- 1Oil & Gas Pipelines

- 1Oil & Gas Production

- 11Oil Refining/Marketing

- 6Oilfield Services/Equipment

- 7Other Consumer Services

- 20Other Consumer Specialties

- 19Other Metals/Minerals

- 10Other Transportation

- 33Packaged Software

- 3Personnel Services

- 2Pharmaceuticals: Generic

- 84Pharmaceuticals: Major

- 6Pharmaceuticals: Other

- 1Precious Metals

- 4Publishing: Books/Magazines

- 7Publishing: Newspapers

- 18Pulp & Paper

- 1Railroads

- 51Real Estate Development

- 22Regional Banks

- 8Restaurants

- 3Semiconductors

- 2Specialty Insurance

- 7Specialty Stores

- 5Specialty Telecommunications

- 64Steel

- 11Telecommunications Equipment

- 84Textiles

- 3Tobacco

- 1Tools & Hardware

- 7Trucking

- 24Trucks/Construction/Farm Machinery

- 25Wholesale Distributors

- 2Wireless Telecommunications

Leave a Reply