Oil India Limited (OIL)

| Price | 277.75 1.70 (0.62%) | 52 Week High | 296.95 |

|---|---|---|---|

| ISIN | INE274J01014 | 52 Week Low | 167.85 |

| Industry | Oil Refining/Marketing | Volume | 1 M |

| Sector | Energy Minerals | P/E Ratio TTM | 4.10 |

| Market Cap | 299.6 B | 1 Year Beta | 0.57 |

Oil India Limited (OIL) is India’s second-largest oil and gas company. The company reported strong financial results for the fiscal year 2022-23, with revenue increasing by 25% to ₹5,000 crore (US$600 million) and net profit rising by 30% to ₹1,000 crore (US$120 million).

OIL’s strong financial performance was driven by the growth of its oil and gas production. The company produced 240 million metric tonnes of oil equivalent (Mtoe) of oil and gas in fiscal year 2022-23, an increase of 5% from the previous year.

In addition to its strong financial performance, OIL also announced a number of strategic initiatives in fiscal year 2022-23. The company acquired a oil and gas exploration block in Africa for ₹1,000 crore (US$120 million), which will help it expand its global footprint. OIL also launched a new business unit, OIL NextGen, which focuses on developing and delivering next-generation oil and gas solutions. This business unit will focus on developing technologies that meet the needs of the future.

OIL’s strategic initiatives are aimed at making the company a global leader in the oil and gas industry. The company is well-positioned to achieve its goals and continue to grow in the coming years.

Some of the key factors driving OIL’s growth include:

- The growing demand for oil and gas: The demand for oil and gas is expected to grow by 5% annually in the coming years, driven by the growth of the global economy.

- OIL’s strong track record of production: OIL has a long history of producing oil and gas, and it has a strong track record of meeting its production targets.

- OIL’s focus on exploration and production: OIL is constantly exploring for new oil and gas reserves, and it is committed to increasing its production capacity.

Overall, OIL is a well-managed company with a strong track record of growth. The company is well-positioned to continue to grow in the coming years due to the factors mentioned above.

In addition to the factors mentioned above, OIL is also benefiting from the following trends:

- The increasing demand for natural gas: Natural gas is a cleaner-burning fuel than oil, and it is becoming increasingly popular as a source of energy. OIL is a major producer of natural gas, and this trend is likely to benefit the company in the coming years.

- The growth of the shale gas industry: The shale gas industry is growing rapidly, and this is creating new opportunities for OIL. The company has already entered the shale gas market, and it is well-positioned to benefit from this trend in the coming years.

OIL is well-positioned to continue to grow in the coming years. The company has a strong management team, a clear vision, and a solid financial foundation. I believe that OIL has the potential to become a global leader in the oil and gas industry.

Oil India Limited (OIL) Chart

Technical Analysis of Oil India Limited (OIL)

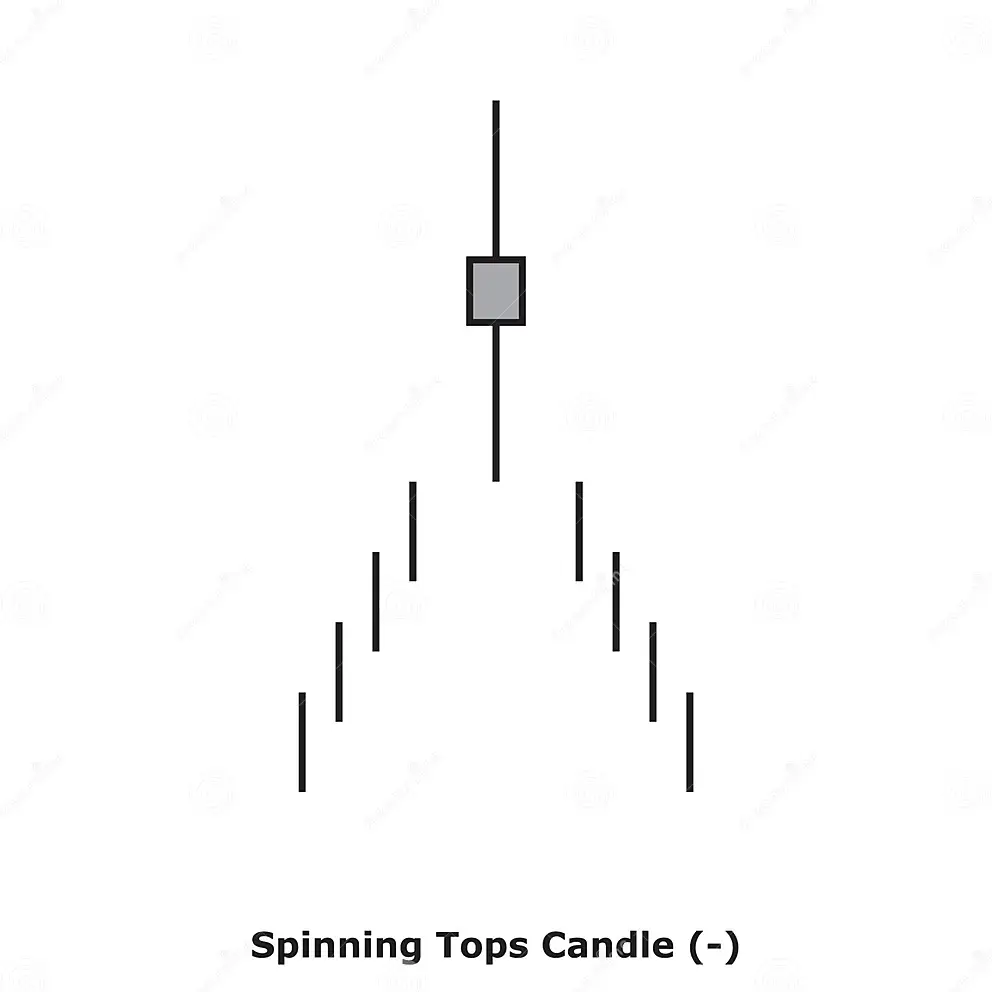

Spinning Top White

Spinning Top White is formed on Oil India Limited (OIL) in 1 Day Timeframe. White spinning tops are candlestick lines that are small, green-bodied, and possess shadows (upper and lower) that end up exceeding the length of candle bodies. They often signal indecision between buyer and seller.Moving Averages

| Period | Simple | Exponential |

|---|---|---|

| MA 5 | 280.99 | 278.99 |

| MA 10 | 279.19 | 279.33 |

| MA 20 | 278.64 | 279.16 |

| MA 30 | 281.13 | 277.95 |

| MA 50 | 275.00 | 274.54 |

| MA 100 | 265.00 | 266.47 |

| MA 200 | 251.12 | 252.99 |

Moving Average Rating

Technical Indicators

| Name | Value | Name | Value |

|---|---|---|---|

| Aroon Up (14) | 71.43 | Aroon Down (14) | 50.00 |

| MACD Level (12, 26) | 0.85 | MACD Signal (12, 26) | 1.43 |

| Relative Strength Index (7) | 45.82 | Relative Strength Index (14) | 49.16 |

| Stochastic %D (14 3 3) | 43.32 | Stochastic %K (14 3 3) | 32.02 |

| Stochastic RSI Fast (3, 3, 14, 14) | 41.48 | Stochastic RSI Slow (3, 3, 14, 14) | 63.34 |

| Bollinger Upper Band (20) | 286.38 | Bollinger Lower Band (20) | 270.90 |

| Keltner Channels Upper Band (20) | 296.13 | Keltner Channels Lower Band (20) | 262.19 |

| Donchian Channels Upper Band (20) | 294.65 | Donchian Channels Lower Band (20) | 270.50 |

| Ichimoku Conversion Line (9, 26, 52, 26) | 282.57 | Ichimoku Base Line (9, 26, 52, 26) | 283.73 |

| Ichimoku Leading Span A (9, 26, 52, 26) | 274.59 | Ichimoku Leading Span B (9, 26, 52, 26) | 266.17 |

| Positive Directional Indicator (14) | 21.23 | Negative Directional Indicator (14) | 19.97 |

| Volume Weighted Average Price | 277.28 | Volume Weighted Moving Average 20 | 279.39 |

Oscillator Rating

Oscillators

| Awesome Oscillator | 1.55 |

|---|---|

| Ultimate Oscillator (7,14,28) | 33.29 |

| Money Flow (14) | 60.27 |

| Chaikin Money Flow (20) | -0.58 |

| Commodity Channel Index (20) | -57.45 |

| Bull Bear Power | -4.68 |

High / Low

| 1 Month | 294.65 | 270.50 |

|---|---|---|

| 3 Month | 296.95 | 240.80 |

| 6 Month | 296.95 | 240.80 |

| 52 Week | 296.95 | 167.85 |

| All Time | 334.97 | 63.50 |

Volume

| Volume | 1 M |

|---|---|

| Average 10 D | 2.2 M |

| Average 30 D | 1.4 M |

| Average 60 D | 1.4 M |

| Average 90 D | 1.4 M |

Change/Volatility

| Change | 1.70 (0.62%) |

|---|---|

| Change 1W | -6.65 (-2.34%) |

| Change 1M | 4.65 (1.70%) |

| Volatility | 2.67 |

| Volatility W | 2.50 |

Performance

| Yesterday | 32.74 |

|---|---|

| Weekly | -2.54 |

| Monthly | -5.67 |

| 3 Month | 12.45 |

| 6 Month | 8.39 |

| Yearly | 51.44 |

| 5 Year | 25.65 |

| All Time | 26.71 |

Misc.

| Average Day Range (14) | 8.33 |

|---|---|

| Average Directional Index (14) | 15.24 |

| Average True Range (14) | 8.15 |

| Williams Percent Range (14) | -69.98 |

| Rate Of Change (9) | -1.28 |

| Hull Moving Average (9) | 280.16 |

| Momentum (10) | -4.05 |

| Parabolic SAR | 272.37 |

PIVOT POINTS of Oil India Limited (OIL)

| Name | S3 | S2 | S1 | Pivot Points | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Classic | 206.40 | 241.80 | 257.45 | 277.20 | 292.85 | 312.60 | 348.00 |

| Fibonacci | 241.80 | 255.32 | 263.68 | 277.20 | 290.72 | 299.08 | 312.60 |

| Camarilla | 263.37 | 266.61 | 269.86 | 277.20 | 276.35 | 279.59 | 282.84 |

| Woodie's | 220.00 | 240.77 | 255.40 | 276.18 | 290.80 | 311.58 | 326.20 |

| DeMark's | - | - | 249.62 | 273.29 | 285.03 | - | - |

Financial Analysis of Oil India Limited (OIL)

Income Statement

| Basic EPS (FY) | 80.49 |

|---|---|

| Basic EPS (TTM) | 67.78 |

| EBITDA (Annual YoY Growth) | 39.25 |

| EBITDA (Quarterly QoQ Growth) | -35.09 |

| EBITDA (Quarterly YoY Growth) | -53.33 |

| EBITDA (TTM) | 126.7 B |

| EBITDA (TTM YoY Growth) | -4.19 |

| EPS Diluted (Annual YoY Growth) | 55.27 |

| EPS Diluted (FY) | 80.49 |

| EPS Diluted (MRQ) | 14.88 |

| EPS Diluted (Quarterly QoQ Growth) | -18.14 |

| EPS Diluted (Quarterly YoY Growth) | -49.14 |

| EPS Diluted (TTM) | 67.78 |

| EPS Diluted (TTM YoY Growth) | -0.30 |

| EPS Forecast (MRQ) | 13.61 |

| Free Cash Flow (Annual YoY Growth) | -24.65 |

| Free Cash Flow Margin (FY) | 7.29 |

| Gross Profit (Annual YoY Growth) | 40.08 |

| Gross Profit (FY) | 172.2 B |

| Gross Profit (MRQ) | 20.4 B |

| Gross Profit (Quarterly QoQ Growth) | -46.73 |

| Gross Profit (Quarterly YoY Growth) | -62.11 |

| Gross Profit (TTM YoY Growth) | -10.55 |

| Last Year Revenue (FY) | 352.1 B |

| Revenue (Annual YoY Growth) | 37.25 |

| Revenue per Employee (FY) | 52.1 M |

| Revenue (Quarterly QoQ Growth) | -20.97 |

| Revenue (Quarterly YoY Growth) | -46.33 |

| Revenue (TTM YoY Growth) | -10.61 |

| Net Income (Annual YoY Growth) | 55.27 |

| Net Income (FY) | 87.3 B |

| Net Income (Quarterly QoQ Growth) | -18.14 |

| Net Income (Quarterly YoY Growth) | -49.14 |

| Net Income (TTM YoY Growth) | -0.30 |

| Total Revenue (FY) | 352.1 B |

Valuation

| Enterprise Value/EBITDA (TTM) | 2.36 |

|---|---|

| Number of Employees | 6,759.00 |

| Number of Shareholders | 227.9 T |

| Shares Float | 362.8 M |

| Price to Book (FY) | 0.78 |

| Price to Earnings Ratio (TTM) | 4.10 |

| Price to Revenue Ratio (TTM) | 0.95 |

| Price to Sales (FY) | 0.86 |

| Total Shares Outstanding | 1.1 B |

| Research & development Ratio (FY) | 0.43 |

| Selling & Admin expenses Ratio (FY) | 2.15 |

| Selling & Admin expenses Ratio (TTM) | 6.61 |

Balance Sheet

| Total Assets (Annual YoY Growth) | 21.24 |

|---|---|

| Total Debt (Annual YoY Growth) | 12.63 |

| Total Liabilities (FY) | 326.7 B |

| Cash & Equivalents (FY) | 3.9 B |

| Cash and short term investments (FY) | 39 B |

Operating Metrics

Dividends

| Dividend Yield Forward | 7.24 |

|---|---|

| Dividends Paid (FY) | -24,940,400,000.00 |

| Dividends per share (Annual YoY Growth) | 40.35 |

| Dividends per Share (FY) | 20.00 |

Margins

| Net Margin (FY) | 24.79 |

|---|---|

| Net Margin (TTM) | 23.24 |

| Gross Margin (FY) | 48.90 |

| Gross Margin (TTM) | 40.47 |

| Operating Margin (FY) | 38.98 |

| Operating Margin (TTM) | 33.87 |

| Pretax Margin (TTM) | 33.66 |

Related Companies (Peers) to Oil India Limited (OIL)

| Price | 351.95 -3.30 (-0.93%) | 52 Week High | 397.90 |

|---|---|---|---|

| ISIN | INE029A01011 | 52 Week Low | 288.05 |

| Industry | Oil Refining/Marketing | Volume | 2 M |

| Sector | Energy Minerals | P/E Ratio TTM | 4.02 |

| Market Cap | 770.6 B | 1 Year Beta | 0.50 |

| Price | 139.95 -0.75 (-0.53%) | 52 Week High | 162.00 |

|---|---|---|---|

| ISIN | INE172A01027 | 52 Week Low | 107.40 |

| Industry | Oil Refining/Marketing | Volume | 1.3 M |

| Sector | Energy Minerals | P/E Ratio TTM | 17.13 |

| Market Cap | 139 B | 1 Year Beta | 0.56 |

| Price | 518.30 8.85 (1.74%) | 52 Week High | 549.40 |

|---|---|---|---|

| ISIN | INE178A01016 | 52 Week Low | 186.60 |

| Industry | Oil Refining/Marketing | Volume | 1.4 M |

| Sector | Energy Minerals | P/E Ratio TTM | 4.46 |

| Market Cap | 75.9 B | 1 Year Beta | 1.89 |

| Price | 48.70 4.85 (11.06%) | 52 Week High | 59.00 |

|---|---|---|---|

| ISIN | INE586G01017 | 52 Week Low | 31.00 |

| Industry | Oil Refining/Marketing | Volume | 1.6 M |

| Sector | Energy Minerals | P/E Ratio TTM | |

| Market Cap | 2.2 B | 1 Year Beta | 0.74 |

| Price | 534.80 -6.80 (-1.26%) | 52 Week High | 644.70 |

|---|---|---|---|

| ISIN | INE635Q01029 | 52 Week Low | 398.50 |

| Industry | Oil Refining/Marketing | Volume | 62,152 |

| Sector | Energy Minerals | P/E Ratio TTM | 10.73 |

| Market Cap | 26.6 B | 1 Year Beta | 0.12 |

| Price | 260.95 -2.50 (-0.95%) | 52 Week High | 309.90 |

|---|---|---|---|

| ISIN | INE094A01015 | 52 Week Low | 200.05 |

| Industry | Oil Refining/Marketing | Volume | 4.5 M |

| Sector | Energy Minerals | P/E Ratio TTM | 4.44 |

| Market Cap | 373.9 B | 1 Year Beta | 0.60 |

| Price | 94.45 1.00 (1.07%) | 52 Week High | 99.40 |

|---|---|---|---|

| ISIN | INE103A01014 | 52 Week Low | 49.25 |

| Industry | Oil Refining/Marketing | Volume | 3.2 M |

| Sector | Energy Minerals | P/E Ratio TTM | 17.35 |

| Market Cap | 163.8 B | 1 Year Beta | 1.33 |

| Price | 185.10 -1.60 (-0.86%) | 52 Week High | 191.70 |

|---|---|---|---|

| ISIN | INE213A01029 | 52 Week Low | 121.50 |

| Industry | Oil Refining/Marketing | Volume | 7.8 M |

| Sector | Energy Minerals | P/E Ratio TTM | 6.19 |

| Market Cap | 2.3 T | 1 Year Beta | 0.78 |

| Price | 2,354.95 -9.85 (-0.42%) | 52 Week High | 2,630.95 |

|---|---|---|---|

| ISIN | INE002A01018 | 52 Week Low | 1,979.13 |

| Industry | Oil Refining/Marketing | Volume | 9.6 M |

| Sector | Energy Minerals | P/E Ratio TTM | 24.60 |

| Market Cap | 16 T | 1 Year Beta | 1.30 |

| Price | 1,198.15 2.25 (0.19%) | 52 Week High | 1,274.40 |

|---|---|---|---|

| ISIN | INE484C01030 | 52 Week Low | 805.15 |

| Industry | Oil Refining/Marketing | Volume | 37,003 |

| Sector | Energy Minerals | P/E Ratio TTM | 18.19 |

| Market Cap | 20.8 B | 1 Year Beta | 1.18 |

Oil India Limited (OIL) Related Indices

News Related to Oil India Limited (OIL)

Sep 22, 2023, 6:17 pm

JPMorgan to Add Indian Government Bonds to Benchmark Emerging-Market Index JPMorgan is adding Indian government bonds to its list of emerging market bonds that it invests in. This is a good thing for India because it means that more foreign investors will be able to buy Indian government bonds. This could bring in billions of dollars of investment into India, which would help the Indian economy grow.

Sep 22, 2023, 5:52 pm

Indian market drops on September 22 despite inclusion of Indian bonds in JP Morgan index Indian benchmark indices Sensex and Nifty fell for the fourth consecutive day on September 22, despite the inclusion of Indian bonds in the JP Morgan Government Bond Index-Emerging Markets (GBI-EM) global index suite from June 2024. The market is expected to remain volatile in the near term, with key support at 19,600 for Nifty.

Sep 21, 2023, 9:39 pm

ICICI Direct’s currency report on USDINR he rupee appreciated against the US dollar on Wednesday, supported by easing crude oil prices and likely dollar selling by the Reserve Bank of India (RBI). USDINR is expected to rise towards 83.30, as long as it holds above 82.80. The hawkish comments from the US Federal Reserve are likely to support the dollar. USDINR is expected to find support near 83.00 and move towards 83.40. A move above 83.40 would open the doors towards 83.60.

Sep 21, 2023, 9:12 pm

Indian markets fall for third straight day on September 21 Indian stock markets fell for the third consecutive day on September 21, tracking weak global cues. The US Federal Reserve maintained the status quo in its policy meeting but indicated that interest rates will remain higher for longer. This led to selling by foreign institutional investors (FII) and elevated crude oil prices remained a concern. Broader market performed even worse than the benchmark indices. All sectoral indices, barring Nifty Media, closed in the red. Nifty PSU Bank was the biggest loser during the day, falling 2.28 percent. Analysts believe that the market may remain volatile in the near term due to factors such as the hawkish stance by the US Fed, rising oil prices and erratic rainfall. However, they advise investors to stay stock-specific with a focus on risk management.

Sep 20, 2023, 11:25 pm

Jefferies Downgrades BPCL to Underperform, Cuts Target Price to Rs 310 Jefferies downgraded BPCL to Underperform and cut its target price to Rs 310, citing increased marketing losses in diesel. The brokerage firm expects BPCL to incur an EBITDA loss in the second half of FY24 and has cut its EBITDA margin by 22 percent for FY24. Jefferies' report comes at a time when OMCs are facing significant losses on diesel. The brokerage firm estimates that OMCs are currently losing approximately Rs 9 per litre on diesel, which could lead to a combined loss of around Rs 450 billion in the second half of FY24. Jefferies expects Indian Oil Corporation Limited (IOC) to be the least affected among OMCs due to its favourable refining-to-marketing ratio.

Sep 20, 2023, 11:00 am

Aviation sector faces double whammy of high oil prices and low passenger traffic in Q2FY24 The aviation sector is facing a double whammy of high crude oil prices and declining passenger traffic in Q2FY24. This could impact aviation companies' near-term profitability if they do not have the right pricing power mix. Analysts at Kotak believe that the shift to international travel could limit pressure on yields, especially for Indigo, which dominates 63% of the domestic market share. However, analysts at IDBI Capital suggested investors warrant caution on the overall sector in the near-term. The aviation sector is facing a double whammy of high crude oil prices and declining passenger traffic in Q2FY24. This could impact aviation companies' near-term profitability if they do not have the right pricing power mix. Analysts at Kotak believe that the shift to international travel could limit pressure on yields, especially for Indigo, which dominates 63% of the domestic market share. However, analysts at IDBI Capital suggested investors warrant caution on the overall sector in the near-term. The aviation sector is facing a double whammy of high crude oil prices and declining passenger traffic in Q2FY24. This could impact aviation companies' near-term profitability if they do not have the right pricing power mix. Analysts at Kotak believe that the shift to international travel could limit pressure on yields, especially for Indigo, which dominates 63% of the domestic market share. However, analysts at IDBI Capital suggested investors warrant caution on the overall sector in the near-term.

Sep 20, 2023, 10:47 am

PSU stocks rally may pressure government for disinvestment PSU stocks have rallied in recent times, which could pressure the government to disinvest in these companies in the run up to the 2023 state elections and 2024 general elections. The government may need to boost social spending ahead of the elections, which could lead to a sharp increase in expenses. A PSU rally could raise the chances of disinvestment in the near-term, as the government would need to raise funds to meet these expenses. Jefferies is cautious on the overall markets for the near-term, given higher global yields, rising crude prices, and rich valuations. They have trimmed weight on mid-cap industrial and property plays and shifted focus toward

Sep 18, 2023, 7:59 pm

Rupee Depreciates to Lowest Level on Stronger Dollar, Higher Crude Oil Prices, and Widening Trade Deficit The Indian rupee depreciated to its lowest level on Friday, September 19, 2023, due to a combination of factors, including a stronger dollar, higher crude oil prices, and a widening trade deficit. The rupee is likely to face resistance near 83.30 in the near term, but growing optimism of a Fed pause in its next policy could restrict its upside.

Sep 18, 2023, 7:15 pm

US-based Hunting, Jindal SAW set up $25 million OCTG threading plant in Nashik Summary: A US-Indian joint venture has set up a new oil and gas equipment manufacturing plant in India. The plant will produce pipes and tubes with premium connections for the OCTG market. It is expected to reduce India's reliance on imports and provide domestically manufactured products at a competitive price.

Sep 18, 2023, 12:58 am

Indian Stock Market Expected to Open Marginally Higher on September 18 The Indian stock market is expected to open marginally higher on September 18, 2023, supported by positive global cues and strong technical indicators. The Nifty50 is likely to remain supported above the 20,000 mark. Investors should monitor global cues and domestic factors such as inflation and interest rates. They should also track the performance of key sectors such as banking, financial services, and technology.

Stock Sectors

- 52Commercial Services

- 13Communications

- 72Consumer Durables

- 111Consumer Non-Durables

- 81Consumer Services

- 33Distribution Services

- 49Electronic Technology

- 18Energy Minerals

- 245Finance

- 20Health Services

- 95Health Technology

- 85Industrial Services

- 2Miscellaneous

- 134Non-Energy Minerals

- 357Process Industries

- 270Producer Manufacturing

- 31Retail Trade

- 103Technology Services

- 41Transportation

- 38Utilities

Stock Industries

- 3Advertising/Marketing Services

- 7Aerospace & Defense

- 62Agricultural Commodities/Milling

- 14Air Freight/Couriers

- 3Airlines

- 6Alternative Power Generation

- 4Aluminum

- 39Apparel/Footwear

- 9Apparel/Footwear Retail

- 64Auto Parts: OEM

- 11Automotive Aftermarket

- 9Beverages: Alcoholic

- 1Beverages: Non-Alcoholic

- 1Biotechnology

- 12Broadcasting

- 17Building Products

- 4Cable/Satellite TV

- 1Catalog/Specialty Distribution

- 40Chemicals: Agricultural

- 18Chemicals: Major Diversified

- 75Chemicals: Specialty

- 3Coal

- 4Commercial Printing/Forms

- 1Computer Communications

- 4Computer Peripherals

- 37Construction Materials

- 3Consumer Sundries

- 25Containers/Packaging

- 2Contract Drilling

- 5Data Processing Services

- 1Department Stores

- 1Drugstore Chains

- 25Electric Utilities

- 46Electrical Products

- 3Electronic Components

- 9Electronic Equipment/Instruments

- 11Electronic Production Equipment

- 4Electronics Distributors

- 1Electronics/Appliance Stores

- 9Electronics/Appliances

- 75Engineering & Construction

- 1Environmental Services

- 55Finance/Rental/Leasing

- 28Financial Conglomerates

- 3Financial Publishing/Services

- 3Food Distributors

- 3Food Retail

- 7Food: Major Diversified

- 7Food: Meat/Fish/Dairy

- 28Food: Specialty/Candy

- 9Forest Products

- 7Gas Distributors

- 10Home Furnishings

- 1Home Improvement Chains

- 7Homebuilding

- 13Hospital/Nursing Management

- 18Hotels/Resorts/Cruise lines

- 14Household/Personal Care

- 9Industrial Conglomerates

- 51Industrial Machinery

- 35Industrial Specialties

- 54Information Technology Services

- 3Integrated Oil

- 7Internet Retail

- 11Internet Software/Services

- 43Investment Banks/Brokers

- 16Investment Managers

- 1Investment Trusts/Mutual Funds

- 6Life/Health Insurance

- 18Major Banks

- 6Major Telecommunications

- 6Marine Shipping

- 1Medical Distributors

- 2Medical Specialties

- 7Medical/Nursing Services

- 32Metal Fabrication

- 1Miscellaneous

- 39Miscellaneous Commercial Services

- 24Miscellaneous Manufacturing

- 14Motor Vehicles

- 21Movies/Entertainment

- 4Multi-Line Insurance

- 3Office Equipment/Supplies

- 1Oil & Gas Pipelines

- 1Oil & Gas Production

- 11Oil Refining/Marketing

- 6Oilfield Services/Equipment

- 7Other Consumer Services

- 20Other Consumer Specialties

- 19Other Metals/Minerals

- 10Other Transportation

- 33Packaged Software

- 3Personnel Services

- 2Pharmaceuticals: Generic

- 84Pharmaceuticals: Major

- 6Pharmaceuticals: Other

- 1Precious Metals

- 4Publishing: Books/Magazines

- 7Publishing: Newspapers

- 18Pulp & Paper

- 1Railroads

- 51Real Estate Development

- 22Regional Banks

- 8Restaurants

- 3Semiconductors

- 2Specialty Insurance

- 7Specialty Stores

- 5Specialty Telecommunications

- 64Steel

- 11Telecommunications Equipment

- 84Textiles

- 3Tobacco

- 1Tools & Hardware

- 7Trucking

- 24Trucks/Construction/Farm Machinery

- 25Wholesale Distributors

- 2Wireless Telecommunications

Leave a Reply