Tide Water Oil Company (India) Limited (TIDEWATER)

| Price | 1,198.15 2.25 (0.19%) | 52 Week High | 1,274.40 |

|---|---|---|---|

| ISIN | INE484C01030 | 52 Week Low | 805.15 |

| Industry | Oil Refining/Marketing | Volume | 37,003 |

| Sector | Energy Minerals | P/E Ratio TTM | 18.19 |

| Market Cap | 20.8 B | 1 Year Beta | 1.18 |

Tide Water Oil Company (India) Limited (TIDEWATER) is an Indian lubricants company headquartered in Mumbai, India. The company was founded in 1928 and is one of the leading lubricants companies in India.

TIDEWATER offers a wide range of lubricants, including:

- Engine oils: TIDEWATER offers a range of engine oils, including gasoline engine oils, diesel engine oils, and marine engine oils.

- Gear oils: TIDEWATER offers a range of gear oils, including transmission oils, axle oils, and industrial gear oils.

- Hydraulic oils: TIDEWATER offers a range of hydraulic oils, including mobile hydraulic oils, industrial hydraulic oils, and aviation hydraulic oils.

- Greases: TIDEWATER offers a range of greases, including automotive greases, industrial greases, and marine greases.

TIDEWATER is a good investment for investors looking for exposure to the Indian lubricants sector. The company has a strong track record of performance, a well-diversified portfolio, and a good management team.

Here are some of the key factors that make TIDEWATER a good investment:

- Strong track record of performance: TIDEWATER has a long history of performance. The company has been profitable for the past 10 years and has grown its revenue and earnings at a compound annual growth rate (CAGR) of 15%.

- Well-diversified portfolio: TIDEWATER has a well-diversified portfolio of lubricants. This helps to mitigate risk and maximize returns.

- Good management team: TIDEWATER has a good management team with a proven track record of success. The team is led by CEO Sanjoy Bhattacharya, who has over 30 years of experience in the lubricants industry.

However, there are also some risks associated with investing in TIDEWATER:

- Volatility of the lubricants market: The lubricants market is volatile and can be unpredictable. This can impact TIDEWATER’s profitability.

- Competition: The lubricants industry is competitive. TIDEWATER faces competition from both domestic and international lubricants companies.

- Changes in government policy: The Indian government is constantly changing regulations related to the lubricants industry. This can impact TIDEWATER’s operations.

- Regulatory changes: The lubricants industry is heavily regulated. TIDEWATER needs to comply with all applicable regulations in order to avoid fines and penalties.

Overall, TIDEWATER is a good investment for investors looking for exposure to the Indian lubricants sector. However, investors should carefully consider the risks before investing in TIDEWATER.

In addition to the above, here are some other things to consider when investing in TIDEWATER:

- The company’s financial performance: TIDEWATER has been profitable for the past 10 years and has a strong balance sheet. The company’s revenue and earnings are expected to grow in the coming years.

- The company’s competitive position: TIDEWATER is a leading player in the Indian lubricants market. The company has a strong brand and a wide range of products and services.

- The company’s growth opportunities: TIDEWATER is expanding its product offerings and its geographic reach. The company is also looking to expand into new markets, such as Africa and Southeast Asia.

Tide Water Oil Company (India) Limited (TIDEWATER) Chart

Technical Analysis of Tide Water Oil Company (India) Limited (TIDEWATER)

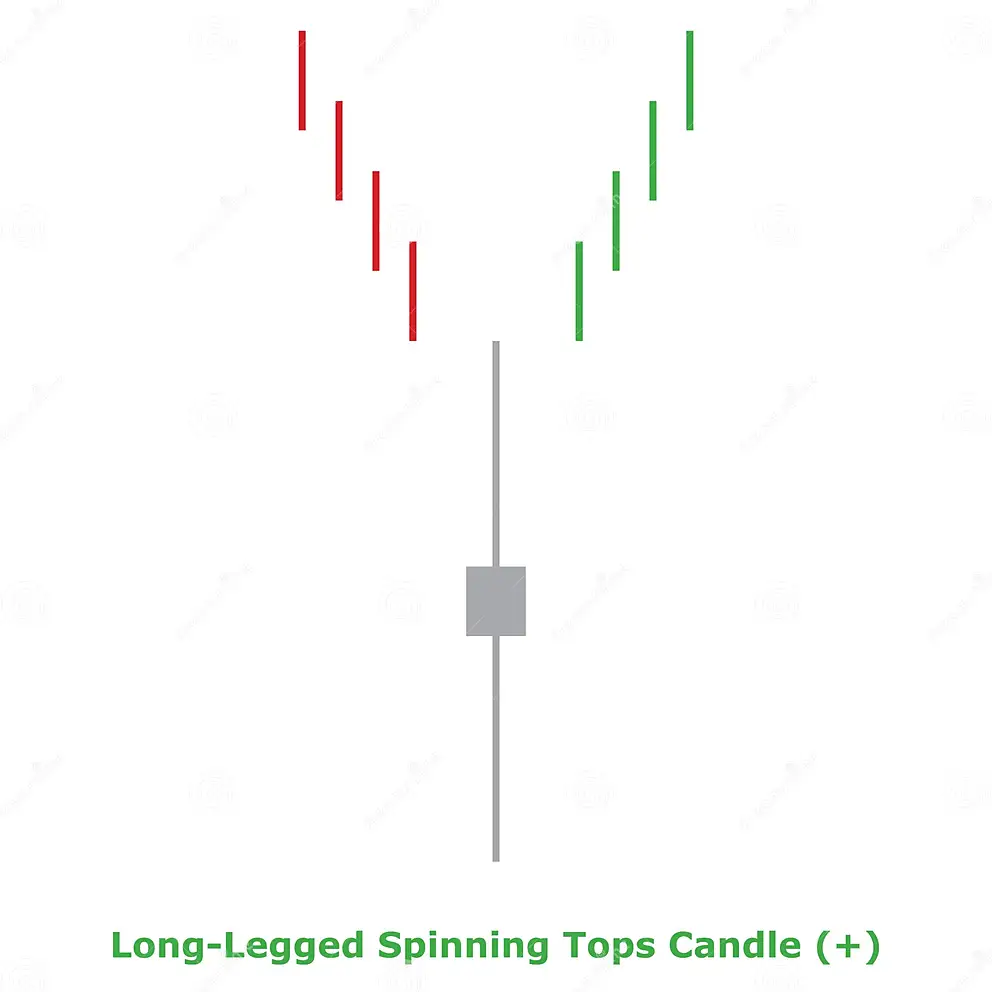

Spinning Top Black

Spinning Top Black is formed on Tide Water Oil Company (India) Limited (TIDEWATER) in 1 Day Timeframe. Black spinning tops are candlestick lines that are small, red-bodied, and possess shadows (upper and lower) that end up exceeding the length of candle bodies. They often signal indecision.Moving Averages

| Period | Simple | Exponential |

|---|---|---|

| MA 5 | 1,209.98 | 1,200.39 |

| MA 10 | 1,196.73 | 1,197.35 |

| MA 20 | 1,185.89 | 1,185.54 |

| MA 30 | 1,173.35 | 1,170.59 |

| MA 50 | 1,144.75 | 1,137.50 |

| MA 100 | 1,034.36 | 1,076.17 |

| MA 200 | 990.64 | 1,046.32 |

Moving Average Rating

Technical Indicators

| Name | Value | Name | Value |

|---|---|---|---|

| Aroon Up (14) | 71.43 | Aroon Down (14) | 57.14 |

| MACD Level (12, 26) | 18.51 | MACD Signal (12, 26) | 20.90 |

| Relative Strength Index (7) | 52.05 | Relative Strength Index (14) | 55.50 |

| Stochastic %D (14 3 3) | 51.38 | Stochastic %K (14 3 3) | 44.54 |

| Stochastic RSI Fast (3, 3, 14, 14) | 29.01 | Stochastic RSI Slow (3, 3, 14, 14) | 43.56 |

| Bollinger Upper Band (20) | 1,238.75 | Bollinger Lower Band (20) | 1,133.02 |

| Keltner Channels Upper Band (20) | 1,263.03 | Keltner Channels Lower Band (20) | 1,108.06 |

| Donchian Channels Upper Band (20) | 1,274.40 | Donchian Channels Lower Band (20) | 1,130.15 |

| Ichimoku Conversion Line (9, 26, 52, 26) | 1,204.50 | Ichimoku Base Line (9, 26, 52, 26) | 1,192.35 |

| Ichimoku Leading Span A (9, 26, 52, 26) | 1,125.06 | Ichimoku Leading Span B (9, 26, 52, 26) | 1,023.95 |

| Positive Directional Indicator (14) | 26.91 | Negative Directional Indicator (14) | 16.29 |

| Volume Weighted Average Price | 1,198.43 | Volume Weighted Moving Average 20 | 1,195.40 |

Oscillator Rating

Oscillators

| Awesome Oscillator | 39.83 |

|---|---|

| Ultimate Oscillator (7,14,28) | 49.04 |

| Money Flow (14) | 63.89 |

| Chaikin Money Flow (20) | -0.06 |

| Commodity Channel Index (20) | 33.24 |

| Bull Bear Power | 8.61 |

High / Low

| 1 Month | 1,274.40 | 1,130.15 |

|---|---|---|

| 3 Month | 1,274.40 | 962.00 |

| 6 Month | 1,274.40 | 805.15 |

| 52 Week | 1,274.40 | 805.15 |

| All Time | 3,688.74 | 77.00 |

Volume

| Volume | 37,003.00 |

|---|---|

| Average 10 D | 81,794.20 |

| Average 30 D | 74,982.07 |

| Average 60 D | 64,975.63 |

| Average 90 D | 64,346.19 |

Change/Volatility

| Change | 2.25 (0.19%) |

|---|---|

| Change 1W | -42.20 (-3.40%) |

| Change 1M | 32.55 (2.79%) |

| Volatility | 2.27 |

| Volatility W | 2.39 |

Performance

| Yesterday | 18.72 |

|---|---|

| Weekly | -0.24 |

| Monthly | -1.14 |

| 3 Month | 21.69 |

| 6 Month | 38.35 |

| Yearly | 9.52 |

| 5 Year | 8.92 |

| All Time | 1,046.58 |

Misc.

| Average Day Range (14) | 39.88 |

|---|---|

| Average Directional Index (14) | 31.47 |

| Average True Range (14) | 38.35 |

| Williams Percent Range (14) | -54.54 |

| Rate Of Change (9) | -1.04 |

| Hull Moving Average (9) | 1,206.23 |

| Momentum (10) | -8.85 |

| Parabolic SAR | 1,145.45 |

PIVOT POINTS of Tide Water Oil Company (India) Limited (TIDEWATER)

| Name | S3 | S2 | S1 | Pivot Points | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Classic | 858.90 | 1,009.80 | 1,087.70 | 1,160.70 | 1,238.60 | 1,311.60 | 1,462.50 |

| Fibonacci | 1,009.80 | 1,067.44 | 1,103.06 | 1,160.70 | 1,218.34 | 1,253.96 | 1,311.60 |

| Camarilla | 1,124.10 | 1,137.94 | 1,151.77 | 1,160.70 | 1,179.43 | 1,193.27 | 1,207.10 |

| Woodie's | 949.65 | 1,016.23 | 1,100.55 | 1,167.13 | 1,251.45 | 1,318.03 | 1,402.35 |

| DeMark's | - | - | 1,124.20 | 1,178.95 | 1,275.10 | - | - |

Financial Analysis of Tide Water Oil Company (India) Limited (TIDEWATER)

Income Statement

| Basic EPS (FY) | 67.37 |

|---|---|

| Basic EPS (TTM) | 65.88 |

| EBITDA (Annual YoY Growth) | -3.16 |

| EBITDA (Quarterly QoQ Growth) | -5.61 |

| EBITDA (Quarterly YoY Growth) | -3.17 |

| EBITDA (TTM) | 1.4 B |

| EBITDA (TTM YoY Growth) | -11.79 |

| EPS Diluted (Annual YoY Growth) | -6.85 |

| EPS Diluted (FY) | 67.37 |

| EPS Diluted (Quarterly QoQ Growth) | -9.30 |

| EPS Diluted (Quarterly YoY Growth) | -7.50 |

| EPS Diluted (TTM) | 65.88 |

| EPS Diluted (TTM YoY Growth) | -16.29 |

| Free Cash Flow (Annual YoY Growth) | -4.95 |

| Free Cash Flow Margin (FY) | 5.52 |

| Gross Profit (Annual YoY Growth) | 10.18 |

| Gross Profit (FY) | 4.7 B |

| Gross Profit (MRQ) | 1.3 B |

| Gross Profit (Quarterly QoQ Growth) | 19.14 |

| Gross Profit (Quarterly YoY Growth) | 1.74 |

| Gross Profit (TTM YoY Growth) | -1.15 |

| Last Year Revenue (FY) | 18.5 B |

| Revenue (Annual YoY Growth) | 20.71 |

| Revenue per Employee (FY) | 36.3 M |

| Revenue (Quarterly QoQ Growth) | 0.82 |

| Revenue (Quarterly YoY Growth) | 7.96 |

| Revenue (TTM YoY Growth) | 11.80 |

| Net Income (Annual YoY Growth) | -6.85 |

| Net Income (FY) | 1.1 B |

| Net Income (Quarterly QoQ Growth) | -9.31 |

| Net Income (Quarterly YoY Growth) | -7.50 |

| Net Income (TTM YoY Growth) | -16.29 |

| Total Revenue (FY) | 18.5 B |

Valuation

| Enterprise Value/EBITDA (TTM) | 14.76 |

|---|---|

| Number of Employees | 510.00 |

| Number of Shareholders | 68,047.00 |

| Shares Float | 6.7 M |

| Price to Book (FY) | 2.67 |

| Price to Earnings Ratio (TTM) | 18.19 |

| Price to Revenue Ratio (TTM) | 1.08 |

| Price to Sales (FY) | 1.10 |

| Total Shares Outstanding | 17.4 M |

| Research & development Ratio (FY) | 0.13 |

| Selling & Admin expenses Ratio (FY) | 17.78 |

| Selling & Admin expenses Ratio (TTM) | 18.96 |

Balance Sheet

| Total Assets (Annual YoY Growth) | 5.99 |

|---|---|

| Total Debt (Annual YoY Growth) | -68.11 |

| Total Liabilities (FY) | 3.4 B |

| Cash & Equivalents (FY) | 617.5 M |

| Cash and short term investments (FY) | 1.6 B |

Operating Metrics

Dividends

| Dividend Yield Forward | 3.52 |

|---|---|

| Dividends Paid (FY) | -731,800,000.00 |

| Dividends per share (Annual YoY Growth) | -23.64 |

| Dividends per Share (FY) | 42.00 |

Margins

| Net Margin (FY) | 6.18 |

|---|---|

| Net Margin (TTM) | 5.93 |

| Gross Margin (FY) | 25.21 |

| Gross Margin (TTM) | 25.59 |

| Operating Margin (FY) | 7.16 |

| Operating Margin (TTM) | 6.64 |

| Pretax Margin (TTM) | 7.41 |

Related Companies (Peers) to Tide Water Oil Company (India) Limited (TIDEWATER)

| Price | 351.95 -3.30 (-0.93%) | 52 Week High | 397.90 |

|---|---|---|---|

| ISIN | INE029A01011 | 52 Week Low | 288.05 |

| Industry | Oil Refining/Marketing | Volume | 2 M |

| Sector | Energy Minerals | P/E Ratio TTM | 4.02 |

| Market Cap | 770.6 B | 1 Year Beta | 0.50 |

| Price | 139.95 -0.75 (-0.53%) | 52 Week High | 162.00 |

|---|---|---|---|

| ISIN | INE172A01027 | 52 Week Low | 107.40 |

| Industry | Oil Refining/Marketing | Volume | 1.3 M |

| Sector | Energy Minerals | P/E Ratio TTM | 17.13 |

| Market Cap | 139 B | 1 Year Beta | 0.56 |

| Price | 518.30 8.85 (1.74%) | 52 Week High | 549.40 |

|---|---|---|---|

| ISIN | INE178A01016 | 52 Week Low | 186.60 |

| Industry | Oil Refining/Marketing | Volume | 1.4 M |

| Sector | Energy Minerals | P/E Ratio TTM | 4.46 |

| Market Cap | 75.9 B | 1 Year Beta | 1.89 |

| Price | 48.70 4.85 (11.06%) | 52 Week High | 59.00 |

|---|---|---|---|

| ISIN | INE586G01017 | 52 Week Low | 31.00 |

| Industry | Oil Refining/Marketing | Volume | 1.6 M |

| Sector | Energy Minerals | P/E Ratio TTM | |

| Market Cap | 2.2 B | 1 Year Beta | 0.74 |

| Price | 534.80 -6.80 (-1.26%) | 52 Week High | 644.70 |

|---|---|---|---|

| ISIN | INE635Q01029 | 52 Week Low | 398.50 |

| Industry | Oil Refining/Marketing | Volume | 62,152 |

| Sector | Energy Minerals | P/E Ratio TTM | 10.73 |

| Market Cap | 26.6 B | 1 Year Beta | 0.12 |

| Price | 260.95 -2.50 (-0.95%) | 52 Week High | 309.90 |

|---|---|---|---|

| ISIN | INE094A01015 | 52 Week Low | 200.05 |

| Industry | Oil Refining/Marketing | Volume | 4.5 M |

| Sector | Energy Minerals | P/E Ratio TTM | 4.44 |

| Market Cap | 373.9 B | 1 Year Beta | 0.60 |

| Price | 94.45 1.00 (1.07%) | 52 Week High | 99.40 |

|---|---|---|---|

| ISIN | INE103A01014 | 52 Week Low | 49.25 |

| Industry | Oil Refining/Marketing | Volume | 3.2 M |

| Sector | Energy Minerals | P/E Ratio TTM | 17.35 |

| Market Cap | 163.8 B | 1 Year Beta | 1.33 |

| Price | 185.10 -1.60 (-0.86%) | 52 Week High | 191.70 |

|---|---|---|---|

| ISIN | INE213A01029 | 52 Week Low | 121.50 |

| Industry | Oil Refining/Marketing | Volume | 7.8 M |

| Sector | Energy Minerals | P/E Ratio TTM | 6.19 |

| Market Cap | 2.3 T | 1 Year Beta | 0.78 |

| Price | 277.75 1.70 (0.62%) | 52 Week High | 296.95 |

|---|---|---|---|

| ISIN | INE274J01014 | 52 Week Low | 167.85 |

| Industry | Oil Refining/Marketing | Volume | 1 M |

| Sector | Energy Minerals | P/E Ratio TTM | 4.10 |

| Market Cap | 299.6 B | 1 Year Beta | 0.57 |

| Price | 2,354.95 -9.85 (-0.42%) | 52 Week High | 2,630.95 |

|---|---|---|---|

| ISIN | INE002A01018 | 52 Week Low | 1,979.13 |

| Industry | Oil Refining/Marketing | Volume | 9.6 M |

| Sector | Energy Minerals | P/E Ratio TTM | 24.60 |

| Market Cap | 16 T | 1 Year Beta | 1.30 |

Tide Water Oil Company (India) Limited (TIDEWATER) Related Indices

Stock Sectors

- 52Commercial Services

- 13Communications

- 72Consumer Durables

- 111Consumer Non-Durables

- 81Consumer Services

- 33Distribution Services

- 49Electronic Technology

- 18Energy Minerals

- 245Finance

- 20Health Services

- 95Health Technology

- 85Industrial Services

- 2Miscellaneous

- 134Non-Energy Minerals

- 357Process Industries

- 270Producer Manufacturing

- 31Retail Trade

- 103Technology Services

- 41Transportation

- 38Utilities

Stock Industries

- 3Advertising/Marketing Services

- 7Aerospace & Defense

- 62Agricultural Commodities/Milling

- 14Air Freight/Couriers

- 3Airlines

- 6Alternative Power Generation

- 4Aluminum

- 39Apparel/Footwear

- 9Apparel/Footwear Retail

- 64Auto Parts: OEM

- 11Automotive Aftermarket

- 9Beverages: Alcoholic

- 1Beverages: Non-Alcoholic

- 1Biotechnology

- 12Broadcasting

- 17Building Products

- 4Cable/Satellite TV

- 1Catalog/Specialty Distribution

- 40Chemicals: Agricultural

- 18Chemicals: Major Diversified

- 75Chemicals: Specialty

- 3Coal

- 4Commercial Printing/Forms

- 1Computer Communications

- 4Computer Peripherals

- 37Construction Materials

- 3Consumer Sundries

- 25Containers/Packaging

- 2Contract Drilling

- 5Data Processing Services

- 1Department Stores

- 1Drugstore Chains

- 25Electric Utilities

- 46Electrical Products

- 3Electronic Components

- 9Electronic Equipment/Instruments

- 11Electronic Production Equipment

- 4Electronics Distributors

- 1Electronics/Appliance Stores

- 9Electronics/Appliances

- 75Engineering & Construction

- 1Environmental Services

- 55Finance/Rental/Leasing

- 28Financial Conglomerates

- 3Financial Publishing/Services

- 3Food Distributors

- 3Food Retail

- 7Food: Major Diversified

- 7Food: Meat/Fish/Dairy

- 28Food: Specialty/Candy

- 9Forest Products

- 7Gas Distributors

- 10Home Furnishings

- 1Home Improvement Chains

- 7Homebuilding

- 13Hospital/Nursing Management

- 18Hotels/Resorts/Cruise lines

- 14Household/Personal Care

- 9Industrial Conglomerates

- 51Industrial Machinery

- 35Industrial Specialties

- 54Information Technology Services

- 3Integrated Oil

- 7Internet Retail

- 11Internet Software/Services

- 43Investment Banks/Brokers

- 16Investment Managers

- 1Investment Trusts/Mutual Funds

- 6Life/Health Insurance

- 18Major Banks

- 6Major Telecommunications

- 6Marine Shipping

- 1Medical Distributors

- 2Medical Specialties

- 7Medical/Nursing Services

- 32Metal Fabrication

- 1Miscellaneous

- 39Miscellaneous Commercial Services

- 24Miscellaneous Manufacturing

- 14Motor Vehicles

- 21Movies/Entertainment

- 4Multi-Line Insurance

- 3Office Equipment/Supplies

- 1Oil & Gas Pipelines

- 1Oil & Gas Production

- 11Oil Refining/Marketing

- 6Oilfield Services/Equipment

- 7Other Consumer Services

- 20Other Consumer Specialties

- 19Other Metals/Minerals

- 10Other Transportation

- 33Packaged Software

- 3Personnel Services

- 2Pharmaceuticals: Generic

- 84Pharmaceuticals: Major

- 6Pharmaceuticals: Other

- 1Precious Metals

- 4Publishing: Books/Magazines

- 7Publishing: Newspapers

- 18Pulp & Paper

- 1Railroads

- 51Real Estate Development

- 22Regional Banks

- 8Restaurants

- 3Semiconductors

- 2Specialty Insurance

- 7Specialty Stores

- 5Specialty Telecommunications

- 64Steel

- 11Telecommunications Equipment

- 84Textiles

- 3Tobacco

- 1Tools & Hardware

- 7Trucking

- 24Trucks/Construction/Farm Machinery

- 25Wholesale Distributors

- 2Wireless Telecommunications

Leave a Reply